ICYMI: Dose of DeFi is looking for more paid writers and researchers. Click here for more information and to apply.

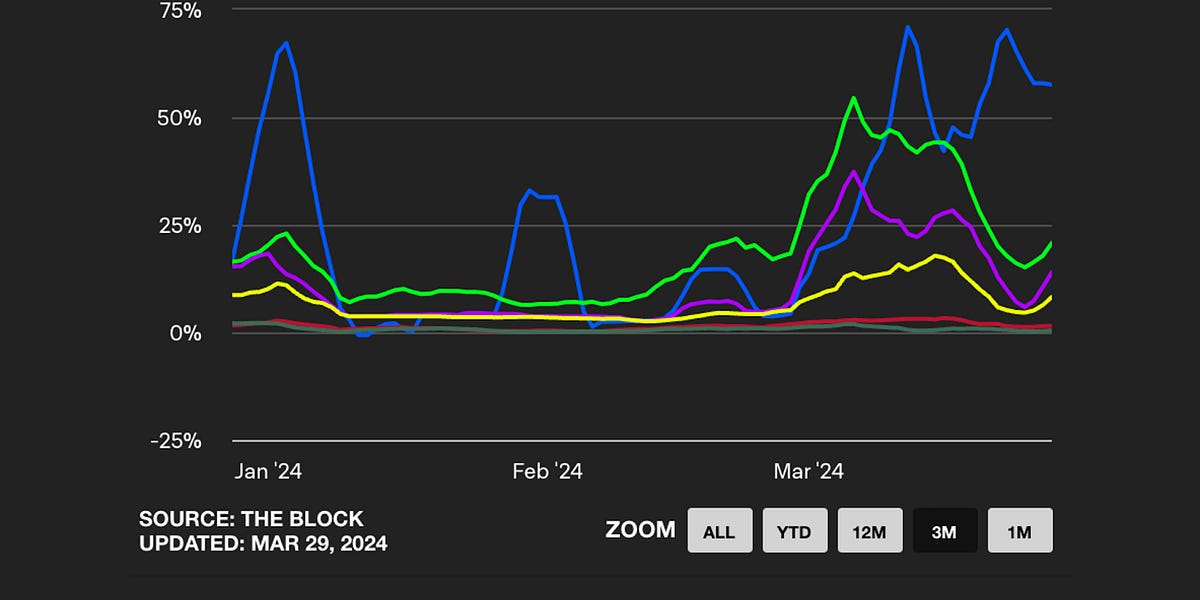

DeFi yields have continued to surge higher. Until very recently, the lending landscape consisted of stalwarts like Maker* and Aave printing money with higher rates while being challenged by a new crop of lending protocols. These newbies, the likes of Morpho and Ajna, entered with more market-based risk management – as we discussed in our January examination of the lending landscape.

That was more or less the state of play until an emergency proposal was submitted to MakerDAO on March 8th to hike interest rates to insulate against the risk of peg instability. The proposal, which was passed and implemented within three days, tripled borrowing rates overnight and raised the Dai Savings Rate (DSR) to 15% (up from 5.5%).

The drastic measures were in response to the sudden success of Ethena’s sUSDe stablecoin. USDe is currently offering 35%+ yield (past seven-day return annualized), generated by tapping into the basis trade on centralized exchanges. Such yield opportunity only exists because investors are so bullish right now, willing to pay high funding rates to stay levered long.

While there was some initial hesitation, long-time DeFi industry leaders have quickly embraced sUSDe and are in a mad dash to integrate it into their lending protocols. Queue the point where we highlight the glaring truth: things could also go south and lead to a painful unwinding if market sentiment (and the funding rate) change quickly. Lenders are currently working to ensure that such risk is mitigated, but this doesn’t negate the obvious: The Yield Wars have begun.

DeFi has always been about yield. After TradFi rates shot up in 2022, DeFi finally has competitive yield that justifies the very real risk, and more importantly, will be much more sustainable than the governance tokens handed out in liquidity mining campaigns in 2021. Ethena is tapping into a novel source of yield, tokenizing it and offering it to DeFi degens. This is a playbook that will be repeated in the future as the black hole of DeFi sucks in any available yield.

Nowadays, all financial innovation in crypto is labeled ‘DeFi’, but the term only started being widely used in 2019. Bitcoin was the OG and what the cool kids call a “paradigm shift”, enabling the digital transfer of value in a censorship-resistant manner. Stablecoins were a further breakthrough in pre-DeFi days. The other big financial innovation in pre-DeFi crypto was the perpetual swap, first developed by Bitmex in 2016.

Perpetual swaps (or perpetual contracts) are similar to a futures contract but do not have a fixed expiry or settlement date. They simply roll over – wait for it – perpetually. They’re also a favorite because they provide easy leverage (Bitmex was notorious for offering 100x leverage). Perpetual swaps are by far the preferred method for going long an asset and using leverage.

These swaps can provide this exposure by maintaining a balance between investors going long and short. This works via a funding rate that incentivizes positions that the system needs to stay balanced. Most perpetual swaps set new funding rates every eight hours. At that point, the system determines the number of longs and shorts and makes a calculated payment to all accounts holding the position it needs to incentivize, and deducts a small amount from those with positions the system has too much of.

As our readers may be aware, crypto investors tend to be hyper bullish, travel in packs, and love leverage (perhaps, ‘gaggle’ is the appropriate collective noun). When the bulls start running, degens buy crypto perpetual swaps to maximize their exposure. Paying interest on this crowded trade is a small price to pay for being a bull. This market dynamic creates arbitrage opportunities for sophisticated traders.

The trade is simple: you hold BTC or ETH and short BTC or ETH. Or better yet, you find the exchange offering the juiciest yield for shorting and the best yield for longing. This is called a delta-neutral strategy because there’s no exposure to the price of the underlying asset. Since both positions are held simultaneously, the value of your position does not change if the price of the underlying asset goes up or down.

Holding spot and shorting futures (or perpetuals), aka the basis trade, is also a popular strategy in TradFi, where hedge funds will take advantage of the market discrepancy created from pension and long-term investors preferring to hold Treasury Futures rather than spot.

Ethena launched as a way to tap into yield from the funding rate on centralized exchanges and offer it onchain. Ethena’s CEO Guy Young says he was inspired by Bitmex founder Arthur Hayes’ ‘Dust on Crust’ post about a scalable crypto stablecoin using perpetual swaps. Ethena’s core product is USDe, a token that is pegged to the dollar and collateralized by a delta-neutral position, one long ETH and one short ETH. USDe holders can stake their tokens and receive sUSDe in return, which comes with the yield that Ethena generates with the collateral backing the token.

The yield passed onto sUSDe holders comes from two sources. First, the long ETH position is in the form of a liquid staking token (LST) which generates 3-4% yield from protocol rewards and MEV. Second, the short ETH position pays handsomely on all major CEXs (upwards of 20-40% annualized yield).

The 20%+ yield on a stable asset without reliance on governance tokens has caught the attention of the market, with many having flashbacks to Luna and perpetual motion machines. Ethena is different. All yield is paid by another investor (or ETH protocol rewards). USDe has seen explosive growth, reaching a $1.4 billion circulating supply just four months after launch.

In total, there is $9.94 billion in open interest on ETH derivatives across CEXs & DEXs, so Etherna is almost 15% of that.

In addition to tapping into a novel source of yield, the other innovation is that USDe can scale relying on crypto collateral with the capital efficiency of USDC/Tether, “ Since the staked ETH collateral can be perfectly hedged with a short position of equivalent notional, the synthetic dollar only requires 1:1 ‘collateralization.’” Its ceiling is the size of ETH open interest, but of course it could also tap into BTC funding, an even larger market.

Launching a new stablecoin is a fairly common occurrence in DeFi. As one of the most successful launches, Ethena introduces new competitive dynamics in the stablecoin market. Those will play out in the coming months, but the popularity of its product and the investor rush to access it has had repercussions across the DeFi lending space. Insatiable investor appetite for sUSDe led to the most drastic interest rate changes at Maker since Black Thursday in March 2020.

Let’s examine why.

Dai has two different types of collateral backing it, with separate feedback loops that contribute to peg stability, interest rates on crypto-collateralized loans, and real-world assets (including the stablecoin USDC), which does most of the heavy lifting for peg management. Maker introduced the Peg Stability Module (PSM), which allows for a 1:1 conversion of Dai to USDC, shortly after Black Thursday. This has ensured a tight peg for the last four years, but also opened Maker up to criticisms as USDC approached 50% of all collateral-backing Dai. Maker drastically reduced this percentage by taking a portion of the USDC in the PSM and investing it in T-bills through Blocktower and Monetalis, and via a similar arrangement with Coinbase Custody.

These moves gave MakerDAO access to the 4%+ yields in TradFi, increasing Maker’s revenue by more than $100 million and paving the way for an increase in the DSR to 5.5%.

The only downside was that this left less USDC in the PSM. Going from T-bills to USDC is doable in theory, but not on DeFi time. So while real-world assets are great for Maker revenue generation, they make Dai slightly less liquid onchain and increase the chance of peg stability issues.

Okay, so back to Ethena and the popularity of sUSDe. Its high yield comes from the high interest rates crypto degens were willing to pay to increase their crypto exposure further. But it’s not itself minted from leverage. So, say you have a stack of ETH and you see this 20% yielding stablecoin. You don’t want to sell your ETH, so you use it as a collateral and borrow against it (at an interest rate much lower than sUSDe yield), then buy USDe and then stake it. Ah, the carry trade. What a classic.

Maker has long been the cheapest source of leverage on crypto collateral in DeFi. Unlike Aave, Compound, or other money market-based lending markets, Maker does not require stablecoin deposits to make stablecoin loans. Importantly, many now access this cheap borrowing through Spark, rather than directly through Maker core, although it’s the same outcome.

So as a diligent crypto degen, your typical flow is borrow Dai against crypto and either: 1. sell Dai and buy more crypto or 2. sell Dai and buy USDe and stake it to get sUSDe and 25%+.

The key to Maker is everyone is minting Dai (good) but selling Dai (bad). This has introduced downward pressure on the peg and with the PSM as an easy exhaust valve, the Dai supply has declined over the last two months, bucking the conventional wisdom that Dai circulating supply expands in bull markets because investors take out more crypto-backed loans.

MakerDAO governance and more specifically Block Analytica was attuned to these dynamics. The growth of sUSDe decreased demand for holding Dai in the DSR, which was only offering 5.5%. While there wasn’t a risk of MakerDAO being insolvent (its collateral is good!), there were significant risks to peg stability with the depletion of USDC in the PSM. And with the weekend approaching (and TradFi markets closed, delaying ability to move more RWAs into USDC), MakerDAO governance acted swiftly to raise interest rates on all crypto-backed loans to 16%+ and set the DSR at 15.5%.

The proposal went up on Friday morning (US time) on March 7th, was passed 24 hours later, and then executed on Monday, March 10th after the 48-hour time lock. The sudden moves and overwhelming show of force are reminiscent of the aggressive actions central banks take to calm markets.

MakerDAO’s actions achieved their primary aim: increasing demand to hold Dai, which also led to a replenishment of the PSM with USDC (currently $636 million of Dai’s $4.5 billion supply). And with the DSR at 15%, more Dai was staked to get sDai.

Some protested with the speed of the hikes – wouldn’t signaling aggressive moves be enough? But overall the market has calmed. Rates are expected to come down slightly but – as crazy as it sounds – 15% seems to simply be the ‘risk-free rate’ in DeFi these days.

Crypto lending has come a long way over the past year. The introduction of RWA assets at scale integrated a bottomless source of yield (T-bills) onchain. Getting 5% onchain was great in the bear market, but pales in comparison to the 25%+ yields degens are getting on centralized exchanges. Like RWAs, Ethena created a link between a source of yield and DeFi. There’s a wide design space for how that yield gets translated onchain but in the end, there’s always going to be a token and an APY.

The existing lending incumbents still can benefit from these new sources of yield because they maintain deep liquid markets. Just today, MakerDAO (through Morpho and Spark) allowed up to $100m of Dai to be borrowed against sUSDe after a quick but thorough risk analysis (Aave is considering as well and Ajna already has an sUSDe pool since its permissionless). This could be a new source of borrowing demand and also tighten the link between the funding rate on perpetual swaps and DeFi credit markets. In the future, lending protocols will be the distribution channels for new sources of yield.

Of course, adding more collateral will introduce more leverage to the system. With sUSDe as collateral on Morpho, all (rational) sUSDe holders will deposit their sUSDe into Morpho, borrow Dai at 16%+ and then buy USDe, stake it and repeat it. This yield optimization strategy is how borrowing rates from CeFi can translate to DeFi.

With high rates and leverage, we should be mindful of how it could all go south. Unlike Luna, a shock to the confidence of the system can’t destroy the underlying value of USDe. There are typical custodial and fraud concerns, and USDe could face its own peg crisis, particularly if there are liquidity issues for an LST, which happened last year with Lido. But the bigger worry is what happens when the source of yield collapses? USDe would still have value, but sUSDe yields would drop to the single digits. Then the unwinding would occur, and while everything appears solvent, major market moves could expose the gaps (think USDC during the SVB crisis) and exploit the weakest link.

So keep calm and carry on, but secure your flank. The Yield Wars are here.

* Most of my working time is spent contributing to Powerhouse, which is an Ecosystem Actor for MakerDAO. MKR is part of my compensation package, so I have a financial interest in its success.

-

1kx raises new $75m fund Link

-

Vaults.fyi, which tracks top yields across DeFi, releases documentation Link

-

Calldata.pics tracks blobs usage after Ethereum’s Dencun upgrade Link

-

Guide to develop dapps on Flashbots’ SUAVE Link

-

IDEX releases vision for IDEX token 2.0 Link

-

Base surpasses $500m in daily DEX volume for four straight days Link

-

Cow-backed MEV Blocker considers adding fee Link

-

BlackRock launches onchain fund with Securitize Link

That’s it! Feedback appreciated. Just hit reply. Written in Nashville, where I love, love, love spring time.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO. All content is for informational purposes and is not intended as investment advice.