The contemporary blockchain conference circuit has increasingly adopted the structure of an industrial trade show. This evolution is neither accidental nor without merit. The “expo” format efficiently concentrates builders, vendors, users, and investors in a single venue, enabling hiring, partnerships, product education, and commercial coordination at scale. These functions are legitimate, and in many cases essential. I do not approach this reality with disdain; in my role as Project Lead at Bancor, I am directly reliant on the connective utility that such events provide.

The concern, however, is not that conferences serve commercial ends, but that commercial optimization has become their dominant (often exclusive) organizing principle. As flagship events have oriented themselves primarily around user acquisition and business development, less space has remained for the forms of intellectual work that originally gave this field its coherence: careful problem formulation, explicit assumptions, technical disagreement, and disciplined critique. The result is not a failure of convening, but a narrowing of what is permitted to matter within the convening itself.

This shift has had consequences. In earlier phases of the industry, ideas were expected to withstand interrogation. Claims were refined through argument. Models were debated publicly, and disagreement was treated as productive rather than impolite. In more mature scientific and engineering disciplines, such practices are formalized through seminars, peer review, and editorial norms. Within blockchain, by contrast, they are often displaced by narrative incentives that reward consistency of message over accuracy, and optimism over examination.

The cumulative effect is subtle but corrosive. Simplified talking points crowd out technical explanation, metrics circulate without definition, and assertions are repeated without models. Disagreements are softened into “community” language rather than resolved through analysis. Over time, serious researchers and practitioners disengage, not in protest, but in recognition that the available forums no longer reward the work they are trained to do. What remains is discourse optimized for repetition rather than understanding. It is against this backdrop that efforts to reintroduce structured, research-first forums matter; not as alternatives to conferences, but as correctives within them.

It is a profound relief to see the Token Engineering Academy (TE Academy) take the initiative to create a forum where the only cost of entry is intellectual discipline: concise exposition, clear problem statements, methods, results, and limitations, with marketing content treated as a category error rather than tolerated background noise. I am proud that Bancor is actively collaborating in the execution of this new, strictly academic forum, the TE Research Symposium (TERSE), premiering at EthCC[9] 2026 in Cannes. I am equally proud to serve on the steering committee that is pushing to make this a real symposium, not a renamed track.

I do not write this as a casual observer of the TE Academy ecosystem, nor as a one-time contributor stepping forward because an event now exists that flatters my preferences. Throughout my tenure as Project Lead at Bancor, I have deliberately utilized public technical forums as a corrective instrument.

My involvement with the TE Academy began in March 2021, during the “Balancer Simulations” program. At that time, I presented a high-level overview of the utility of elastic-supply tokens as well as a use case for AMMs in trading insurance-linked securities (ILS), a notable and early foreshadowing of the current discourse on Real-World Assets (RWAs). In July 2023, during the TE Academy track of EthCC[6] in Paris, I spoke about Carbon Defi (Bancor’s flagship exchange product) for the first time in front of a live audience.

While still servicing the need to introduce, then, a relatively new concept in onchain exchange primitives, the talk was nonetheless a technical account of the product design and its mathematical structure. That technical correctness and pedagogical objectives should take priority over a cheap opportunity to shill a product has largely characterized all public seminars I have delivered for Carbon DeFi, with and without the TE Academy, as evidenced by my work at ETHWarsaw[3] and ETHWarsaw[4] (September, 2024 and 2025), Devconnect (November, 2025), ETHDubai (April, 2024), and NapulETH (September, 2024). This emphasis also extends to my written contributions. Even in my relatively infrequent posts on this blog, my treatment of Carbon DeFi is predominantly technical and centered on implementational details rather than narrative positioning. A representative example is “Theory vs Reality: The Precision and Accuracy of Carbon DeFi’s Fixed-Point Arithmetic”.

In July 2024, during the TE Academy track of EthCC[7] in Brussels, I presented “Fixing Objectively Bad Models in LP Performance Evaluations”. This talk was not product-oriented; it was a critique of prevailing industry practices, including a specific argument that the term “fees”, as commonly used in AMM performance narratives, fails as a coherent analytical object and should be discarded.

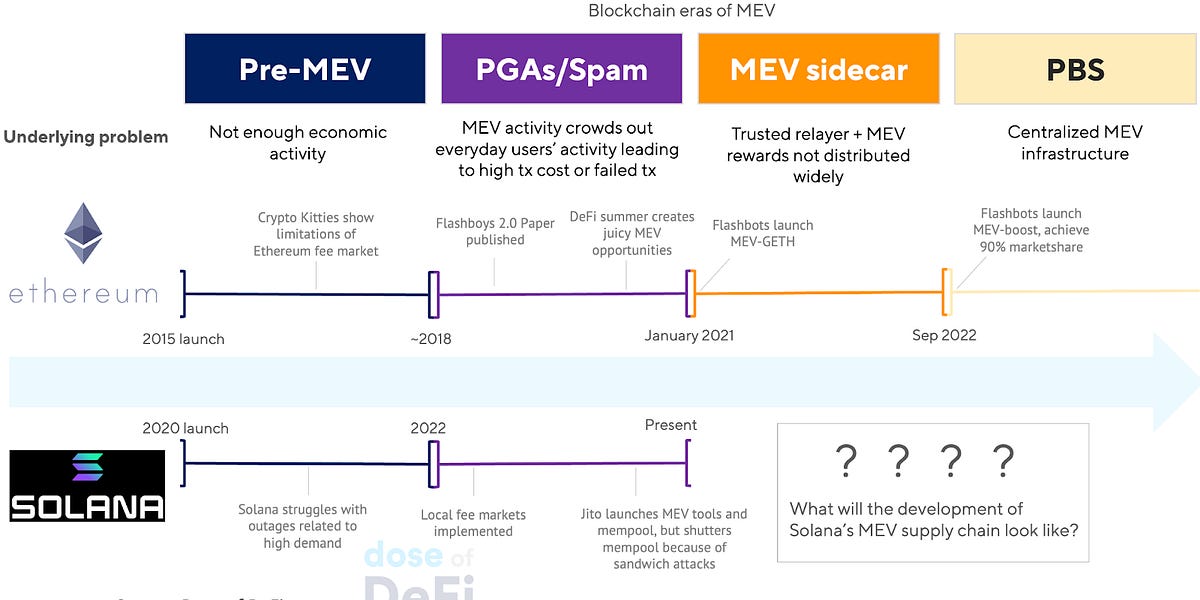

I have maintained such non-product, industry-first objectives outside of TE Academy programming and with explicit claims that can be scrutinized, falsified, and improved. In October 2024, I presented a technical treatment of DEX MEV at MEVShanghai. This talk was later refined for ETHDubai (April 2025), separating sandwich attacks from arbitrage and insisting on precise claims about who bears which costs, and under what assumptions. In June 2025, I delivered a sandwich-attack-focused version at ETHBelgrade, and an even more thorough version for the University of Zurich Blockchain Center in December 2025. Related treatments also appear in my written work, including “The Optimum Sandwich: How to Exploit Blockchain Enthusiasts with Arbitrary Precision” and “The Forbidden Sandwich: A Theory of MEV-resistant CFMM Transactions”.

In April 2025, during the TE Academy track of EthCC[8] in Cannes, I assumed the role of a critical interlocutor, chairing the “TE Unplugged” session. Rather than providing the customary “soft validation” common at crypto events, my role was to provide a form of real-time, public peer review for speakers Vasily Sumanov (Valueverse.ai) and Phillip Zahn (20squares) after their talks. This “agreeably disagreeable” posture, grounded in open criticism, is exactly what TERSE seeks to revive.

In October 2023, I delivered a four-part lecture series for the Bonding Curve Research Group, which served as the progenitor for a five-part postgraduate-level lecture series “DeFi’s Concentrated Liquidity From Scratch” (and an accompanying 85-page textbook) for the TE Academy Study Season (April-July 2024).

This record is the reason I am willing to speak plainly. My relationship with the TE Academy provides provenance earned through a consistent body of technical work across multiple years and formats, from foundational lecture series and published course material to public critical inquiry. It has allowed me to inhabit a role that is too often absent from the conference circuit, which treats discourse as an arena for interrogation rather than a venue for marketing theater.

In my view, TERSE is the formalization of this posture. It is a concerted effort to restore a durable bridge between theoretical research and deployed systems, where models, specifications, and empirical claims are treated as primary objects, and where persuasion is subordinate to explanation. By anchoring this symposium at the heart of the largest blockchain and cryptocurrency conference in Europe, we are setting a standard for what constitutes legitimate work in this field. TERSE is designed as a space where ideas are rewarded only insofar as they survive contact with properly informed criticism.

TERSE is a pragmatic effort to provide a public home for the conversations many of us already conduct in smaller rooms. Bonding curve invariants, simulation results, formal verification, and governance trade-offs are already discussed with care in private. TERSE proposes that this mode of discourse should have a permanent place at the center of our industry’s most visible gatherings. Accordingly, we invite researchers and practitioners who seek a forum where technical work is the primary event. Formal pedigree and institutional affiliation are irrelevant. The requirement is the work itself, submitted as a manuscript and presented without promotional intent.

We welcome submissions across token engineering and cryptoeconomics. Relevant topics include protocol and mechanism design, incentive and market design, verification and simulation, governance and economic security, and research that spans technical, economic, and legal constraints. Both peer-reviewed papers and work in progress are appropriate, provided the submission is research-driven and non-promotional. Review will be attentive and constructive. The criteria are clarity of the research question, defensible assumptions, methodological rigor, and an explicit account of what the results establish and what they do not.

If a proposal is accepted, the expectation is simple: the talk must teach. A specific project may motivate the work, but the presentation must remain centered on the question, the approach, and the findings. Persuasion must remain subordinate to explanation. TERSE also relies on reciprocity; a rigorous program is a reciprocal exchange of intellectual labor. Authors may be asked to review the work of others with the same care they would expect for their own.

TERSE is a forum for workers.

If you have work that deserves a careful hearing, I enthusiastically encourage you to submit.

Symposium Details

Submission Deadline: February 20, 2026

Event Date: March 31, 2026

Location: Cannes, France (EthCC[9])

Submission Portal: [LINK]

The Case for Constructive Adversarialism at Mainstream Conferences was originally published in Bancor on Medium, where people are continuing the conversation by highlighting and responding to this story.