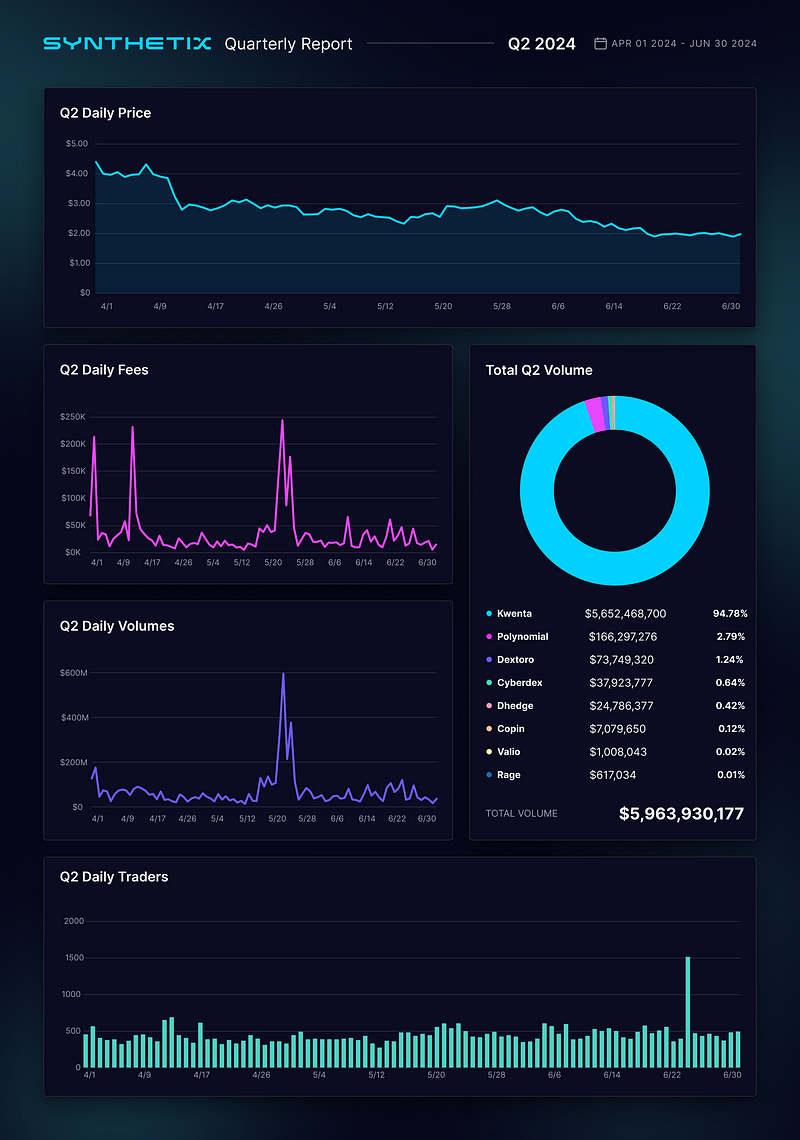

Quarterly Report for Synthetix, Quarter 2 of 2024: April — June.

👉Q2 Highlights

⭐ Spartan Council/CCs: V3 Scaling & Arbitrum Deployment

⭐ Ambassador Council: OP Grants

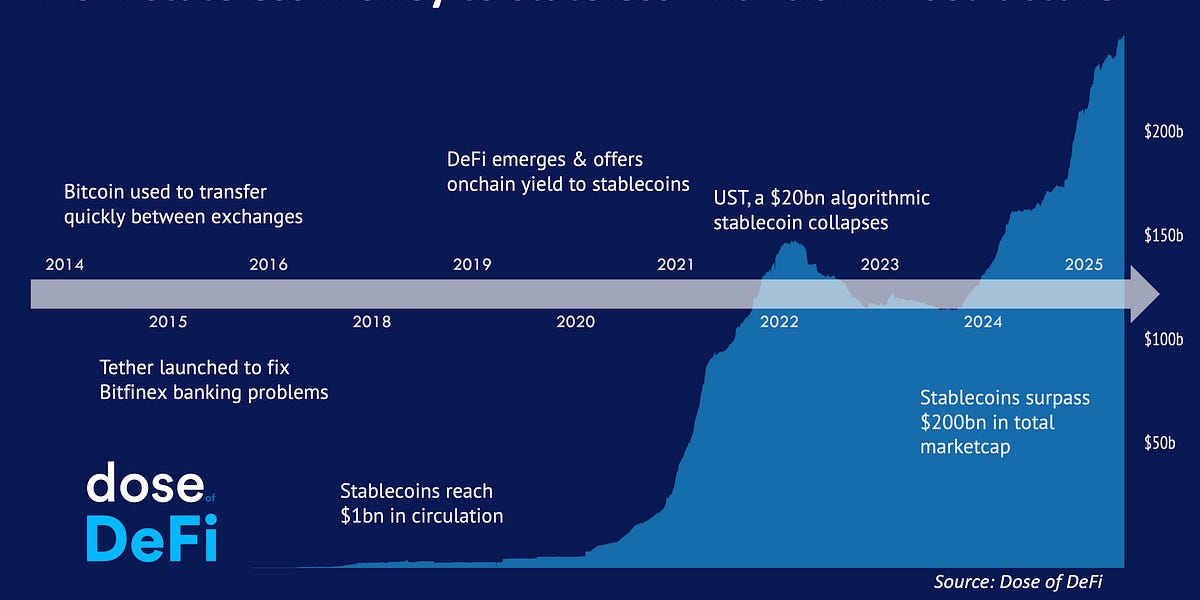

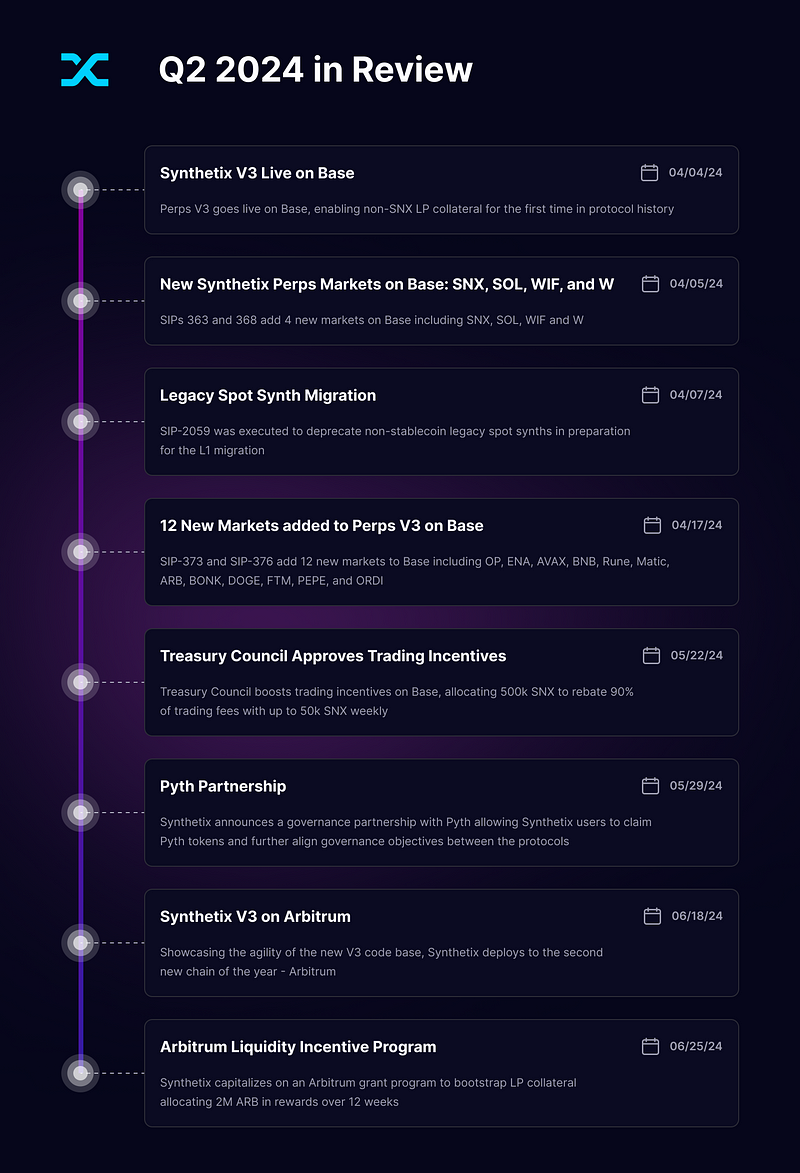

The past few months have been a period of dynamic growth and strategic expansion for Synthetix, underscored by the successful launch of Synthetix V3 on Base and Arbitrum, and a series of exciting new market listings and incentive programs. As we navigate these changes, let’s take a moment to review some of the key highlights and challenges faced by the Synthetix Protocol in Q2.

One of the biggest milestones that the Core Contributors (CCs) have been tracking since the V3 launch on Base was the scaling of the Perps product to $100 million in daily volume and $20 million+ in LP collateral. These milestones aimed to test two base cases — would users be interested in trading on-chain Perps wherever the strongest product existed with the lowest fees AND would LPs be interested in providing collateral other than SNX (for a fee).

Although trading volumes haven’t quite hit the $100 million target (though occasionally topping $50 million in a single day) it has been made clear that there is an appetite for LP opportunities. The LP milestone was reached just a month after the cap was raised from $10 million, peaking around $25 million. Much of the efforts now have been focused on directing traders towards the product that integrators have been incentivized to spearhead via the V3 fee sharing model.

Another pivotal moment for the protocol this quarter was the deployment to Arbitrum, an Ethereum Layer 2 scaling solution. This strategic move aimed to enhance transaction efficiency, reduce costs, and improve user experience for the Synthetix ecosystem. By leveraging Arbitrum’s rollup technology, Synthetix will be able to continue offering significantly lowered gas fees and transaction costs, enabling more seamless and cost-effective trading for users on yet another chain in the second isolated deployment of the year.

This deployment reinforces Synthetix’s commitment to staying at the forefront of DeFi and showcases the protocol’s newfound agility in V3 to follow strong user bases and spin up best-in-class Perps markets where demand is strongest.

The deployment will also feature support for yield-generating collateral, allowing LPs to collect rewards while maintaining exposure to a secondary yield source. There has been quite a bit of enthusiasm surrounding this deployment and, as with the Base deployment, fees will be shared with Synthetix stakers via a buyback and burn mechanism.

Synthetix was awarded a grant at the end of June from the Arbitrum Long Term Incentive Program (LTIP) and the plan to use those funds to attract liquidity providers was approved by Arbitrum and began in the middle of June. This program so far has attracted nearly $25 million in LP collateral!

In addition to their role in securing the LTIP grant from Arbitrum, the Ambassadors were instrumental in securing three additional OP grants for ecosystem partners in Q2. The first was the Polynomial Optimistic Indexer grant, which aims to develop a robust indexing solution for the Optimism blockchain, improving data accessibility and reducing latency for users. The second was the Superchain Trading Tools grant which seeks to enhance the trading infrastructure on the Optimism network, providing advanced tools and features to optimize trading strategies and execution. Finally, the Strands Optimism Integration Acceleration grant focuses on accelerating the integration of Strands’ financial technology solutions with the Optimism ecosystem, promoting innovation and broader adoption of decentralized finance applications on the platform.

Lastly for the highlights, we’d also like to give a shoutout to Synthetix designer Steve for all of the graphics you see in this blog post!🙏

👉Challenges

After an explosive first quarter for Perps V2, which saw over $10 billion in trading volume, activity seems to have cooled a bit in Q2 with only about $6 billion in volume recorded through the end of June across Optimism and Base. Open interest on Base peaked at around $8 million in June — just a small fraction of the available cap space. Without additional incentives to keep LPs interested, trading activity, and the rewards generated from it, will need to sufficiently entice LPs to keep their collateral tied up in that deployment.

The decline in trading activity wasn’t limited to Base, however, as lower volatility and onchain perps trading volume appeared to be a broad trend throughout the space. Last quarter, we reported the protocol had crossed the $50 billion milestone in cumulative volume in large part due to the strong performance of Perps V2 on Optimism. The second quarter saw volumes drop more than 50% on Optimism to $4.5 billion.

Despite these challenges, the protocol remains committed to innovation and growth. A SIP recently made it through governance to deliver on the protocol’s promise to build a best-in-class orderbook Perps DEX which may attract a larger user base looking to trade on-chain Perps at the lowest cost.

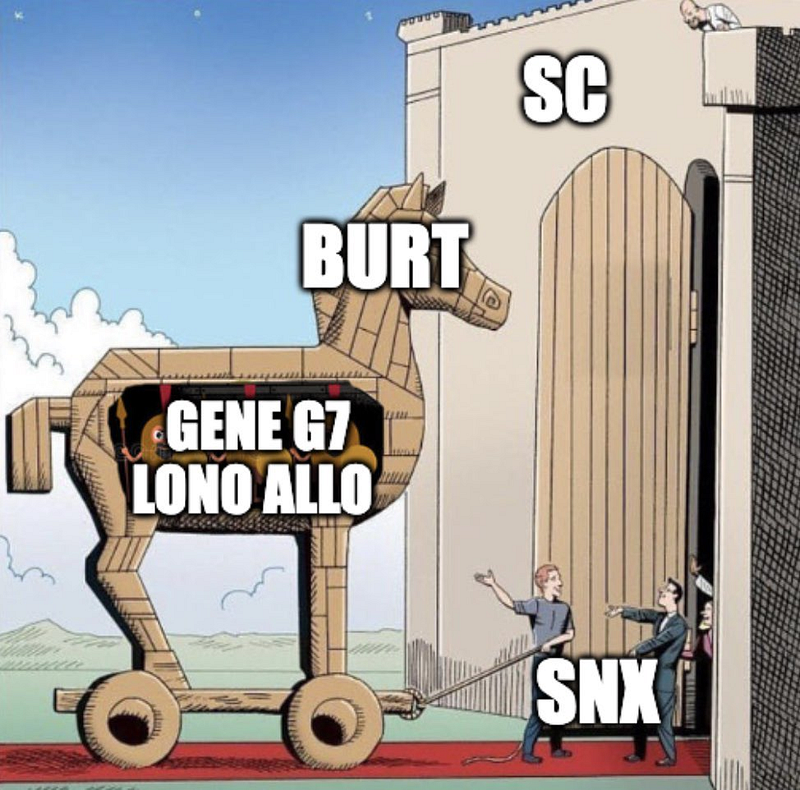

At the beginning of the quarter, the Treasury council announced a plan to allocate funding to build out a Perps market on Solana. This triggered a governance debate that has surfaced several times in the current governance framework of Synthetix. The Treasury Council took this action unilaterally and there were a few members of the Spartan Council who voiced some concern, given that the Spartan Council is tasked with developing and executing the strategic direction of the protocol.

The Treasury Council, however, has always had the discretionary authority to act in the protocol’s best interest as they see fit and are elected in a non-quadratic, straight token majority vote to do so. Kain has been a staunch defender of maintaining a body with this level of freedom to act on behalf of the token holders swiftly when such action is necessary. Still, some on the Spartan Council felt that the Spartan Council should be consulted on such plans.

Staying on the topic of governance, a much smaller issue arose towards the end of the quarter when a SIP was proposed that would eliminate the need for presentation when adding new Perps markets. Even with full support of the council, the question arose as to whether the SIP should be classified as meta-governance or not.

It was later agreed upon that the SIP was in fact meta-governance, but Burt flagged that there didn’t seem to be a specific set of guidelines for making such determinations and offered to write a SIP clarifying the rules.

And how can we forget about SNAX chain. While still not fully fleshed out, there are some in the community who believe an SNX Appchain might be able to serve as a central governance hub for the protocol. The idea seems promising, but the council was split down the middle with some councilors highlighting that the technology is still in its infancy and the protocol has been burned before being the first movers. We will certainly be monitoring the progress of this discussion in the coming months.

👉Protocol Stats

Overview of Synthetix Q2 Stats: April 2024 — June 2024.

👉Spartan Council

Q2 2024 Spartan Councilors: Afif, Cavalier, Cyberduck, Jackson, Millie, ml_sudo, Snaxfrens, and Snxmaximalists

Along with their contribution to the achievement of major Synthetix milestones this quarter, let’s take a minute to review everything else that the Spartan Council was able to achieve in just the last 3 months.

In April, the Council took the first steps towards deprecating non-sUSD spot synths with SIP-369. The spot synths generated a lot more risk exposure for the debt pool than delta neutral Perps markets without generating enough fee revenue to justify that risk. The deprecation of these synths will eventually pave the way for SNX L1 migration that will support a new Perps market on Ethereum mainnet. All holders of these synths were given ample opportunity to redeem them at favorable rates and the exchange of these synths has been fully deprecated at this point. Users have been directed to contact the Treasury Council to retrieve previously unclaimed funds.

The council also approved SIP-376 which added Ethena’s sUSDe as a supported collateral type on Arbitrum to scale the deployment faster and 16 new markets to V2 and V3 including for the first time: an SNX Perp on Base! This was previously considered to be difficult to support in V2 since the debt pool was comprised of exclusively SNX collateral.

In May, the Spartan Council continued its efforts to enhance the protocol’s functionality. As a first, we saw support added for the yield-generating aUSDC to be used as LP collateral on Perps V3. As Perps V3 was nearing the end of its early live testing phase, SIP-378 pushed through several integrator improvement requests, including removing acceptable price checks on order commitment and allowing 0 fee perp trading.

May also saw massive trading incentives added to Perps V3, rebating up to 90% of user trading fees for 10 weeks and the approval of multi-collateral margin. Multi-collateral margin was a feature that was supposed to be available at the launch of Perps V3 but ran into some implementation challenges. Rather than delaying the launch, the Spartan Council opted to make Synthetix Perps trading on Base available as soon as possible and delay the much-anticipated multi-collateral margin feature.

In June, a new framework for automating Perps listings was approved unanimously by the Spartan Council. SIP-387 highlighted that the process is all but automated anyway with no meaningful objections being surfaced in any of the presentations to add these new markets. Most of the risk assessment happens in the parameter setting SCCP anyway, which already requires no presentation. It became clear that there may be some value in being able to get popular new tokens on the market faster than is possible in the current presentation process, given the council meets only once a week to hear these presentations.

Synthetix V3 was also deployed to Arbitrum in June and SIP-389 was approved, greenlighting support for even more yield generating collateral options to help boost liquidity quickly.

To round out the quarter, the council heard and approved a proposal to add a new supermarket/pool on V3, coined Degenthetix, to serve as a sandbox for experimentation with Perps trading for longtail assets.

👉Ambassador Council

Q2 2024 Ambassador Councilors: Dsacks, GUNBOATs, mastermojo, Matt, and Westie

The Synthetix Ambassadors have closed out another quarter of promoting the interests of the protocol through governance participation, various DAO collaborations, and community support. As seen in the graphic below, the ever-growing Synthetix ecosystem creates a web of DeFi partners throughout which the Ambassadors have stayed active.

The Ambassador Council’s three main focuses remained during Q2:

- DeFi Governance: Optimism Governance (which involved Token House and Citizen House), as well as other DeFi DAOs (such as Arbitrum, Gearbox, Safe, Lyra, Aave, etc.)

- Integrator support: Current & future — Guiding core contributors, integrators, and more through the processes of grants, retroactive funding, and other ways to secure valuable funds

- Marketing Support: Spartan Spaces & Twitter involvement

Now let’s get into a more detailed list of what the Council has accomplished this quarter:

✅ OP Grants

The Ambassadors remained vigilant in their assistance of ecosystem partners in the Optimism Grant process. This quarter, they also helped Synthetix secure a LTIP Grant on Arbitrum, on top of 3 Optimism Grants:

1. Synthetic Arbitrum LTIP : 2 million ARB

For details about the Arbitrum Grant Liquidity Incentive Program check out this blog.

2. Polynomial Optimistic Indexer: 40K OP

The purpose of this grant is to develop a robust indexing solution for the Optimism blockchain, which will improve data accessibility and reduce latency for users.

3. Superchain Trading Tools (Troy): 40k OP

This proposal seeks to enhance the trading infrastructure on the Optimism network, providing advanced tools and features to optimize trading strategies and execution.

4. Strands Optimism Integration: 35k OP

Lastly, this grant will accelerate the integration of Strands’ financial technology solutions with the Optimism ecosystem, promoting innovation and broader adoption of decentralized finance applications on the platform.

For those who applied for Optimism Grants and did not make it through in this round, the Ambassadors want it to be known that the decision was purely budgetary. They have worked one-on-one with protocols to ensure that they are ready to go for subsequent rounds, which will start at the end of July. The next round of Optimism Grants will also include the Superchain, which now enables grants on Base! The Council is expecting to work with many ecosystem projects in the next round to prepare them for this.

✅ Retroactive Funding

In June, the Ambassadors also assisted ecosystem partners in applying for Optimism Retroactive Funding Round 4. During this round, the Optimism Collective allocated 10 million $OP to reward Superchain builders, deciding to dedicate this round specifically to on-chain builders in order to:

1. Incentivize contributor growth and network activity

2. Be more inclusive towards longtail contributors

3. Build upon the significant growth in developer activities since Round 3

The Synthetix Ambassadors worked with ecosystem partners to ensure that they understood the criteria and selection process, and as a result several projects made the Final Cut:

- Synthetix

- Kwenta

- Thales

- dHEDGE/Toros

- Polynomial

- TLX

- Copin

- Keng Lernitas

- Pyth Network

The funding amount secured should be released in the coming weeks.

✅ Governance

1. General Governance

The Ambassadors always want to make sure they’re staying transparent with their voting. As always, their activity can be followed through their wallets on Snapshot and Tally.

Voting Activity can be followed using these links:

2. Optimism Governance Forum Activity:

The Synthetix Ambassadors remain a major voice in Optimism Governance, and their respective OP Governance Forum Activities can be found using these links:

3. X/Twitter Engagement

The Ambassadors also post quick governance updates on X, and posted two this quarter:

Ambassador Dsacks also did a deep dive into TLX on X, here, following the Council’s Spartan Space with the protocol.

4. Partner Support

Current Partners

- The Ambassadors have continued to check in on partners and work with them on any feedback, support requests, DeFi grant assistance/guidance, etc.

Future Partners

- The Council plans to focus on Perps V3 and Synthetix V3 in the next epoch when it comes to future partnerships. They are currently in talks with future partners to build on top of Synthetix Perps either as a frontend or otherwise, and they will be continuing these efforts into the new quarter.

- They are also monitoring changes to retroactive public goods funding (RPGF), which appears to be fruitful for Synthetix on Base & OP as onchain builders and ecosystem partners

✅ Spartan Spaces

Spartan Spaces continued to serve as important community marketing tools this quarter, with the Ambassadors hosting a few other DAOs on behalf of Synthetix.

1. Cyberdex (Length: 35 minutes)

- CyberDEX is a decentralized perpetual swaps trading platform functioning on Optimism and powered by Synthetix.

- Guests: Cyborg (founder), Config (front end dev), NotAPriest (dev), Picante (head of growth), and Mohammed (product designer)

- Recording here

2. TLX (Length: 1 hour)

- TLX is a new leverage token protocol built on Synthetix.

- Guest: Max

- Recording here

✅ Synthetix Governance Proposals

1. SIP-382: List FRIEND-PERP on Perps V3 on Base (author: Dsacks)

2. SIP-388: Adding Support for EtherFi weETH to Arbitrum V3 LP (author: Dsacks)

3. SIP-389: Adding Support for Yield Tokens from Aave and Lido to Arbitrum V3 LP (author: Dsacks)

What’s next for the Ambassadors?

In the next quarter, the Ambassador Council plans to focus on the following:

- Obtaining more Arbitrum delegations and expanding into Arbitrum governance

- Other DeFi DAOs (Lyra, Gearbox, Safe, etc)

- Integrator support: helping CCs and integrators with grants, retroactive funding, etc.

- Continuing marketing support

- Pursuing further growth strategies for Perps and Synthetix V3

- Exploring opportunities to scale synth supply

- Increasing presence in Optimism governance (Optimism Token House, Citizen House, Grants, RPGF)

- Expanding influence in DeFi & DeFi Governance

👉Best Memes from Q1

The quarter of COURSE wasn’t without humor, so here are our favorite memes from the quarter: