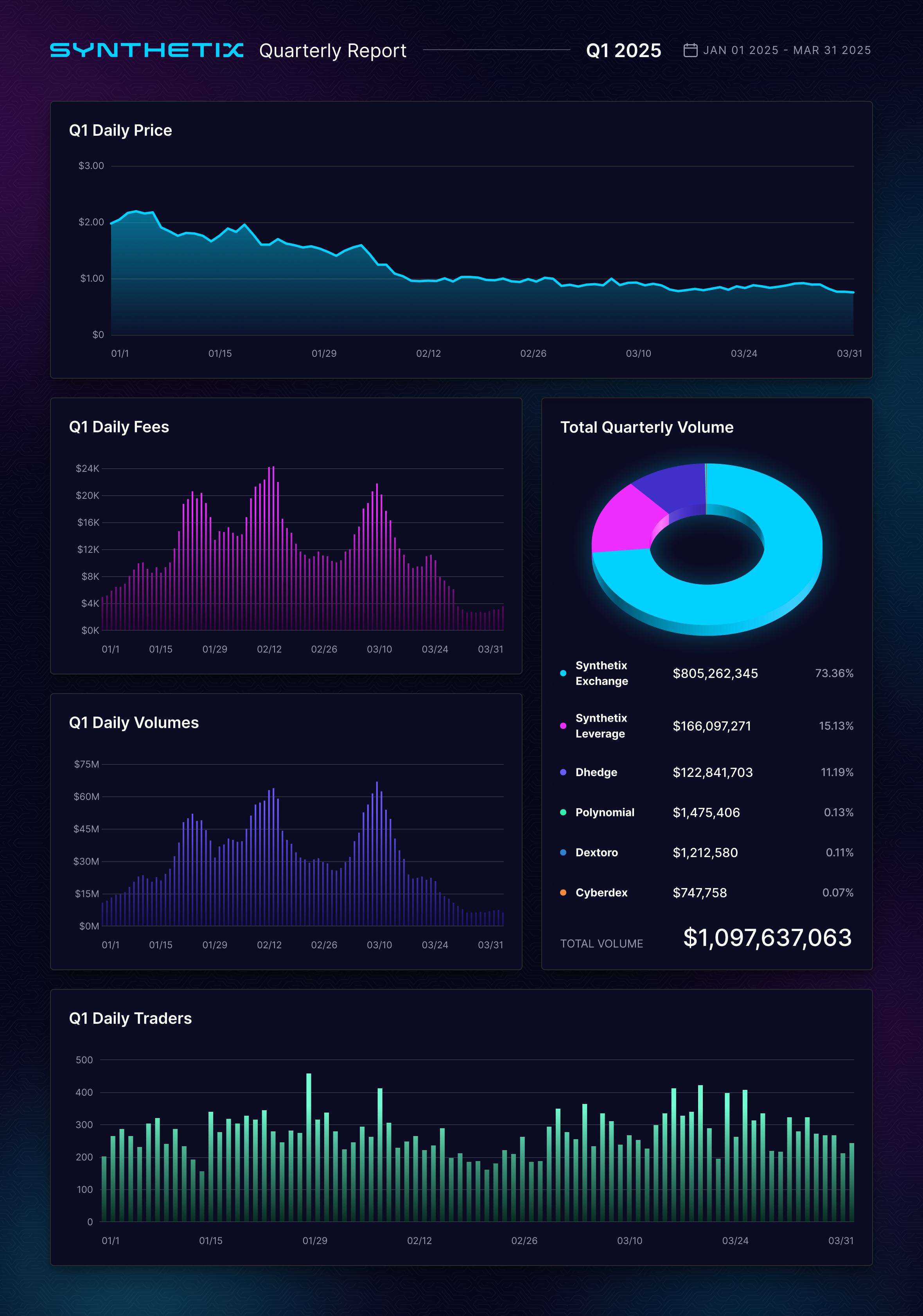

Quarterly Report for Synthetix, Quarter 1 of 2025: January — March.

Q1 Highlights

⭐ Spartan Council/CCs: 420 Pool, Alpha Calls

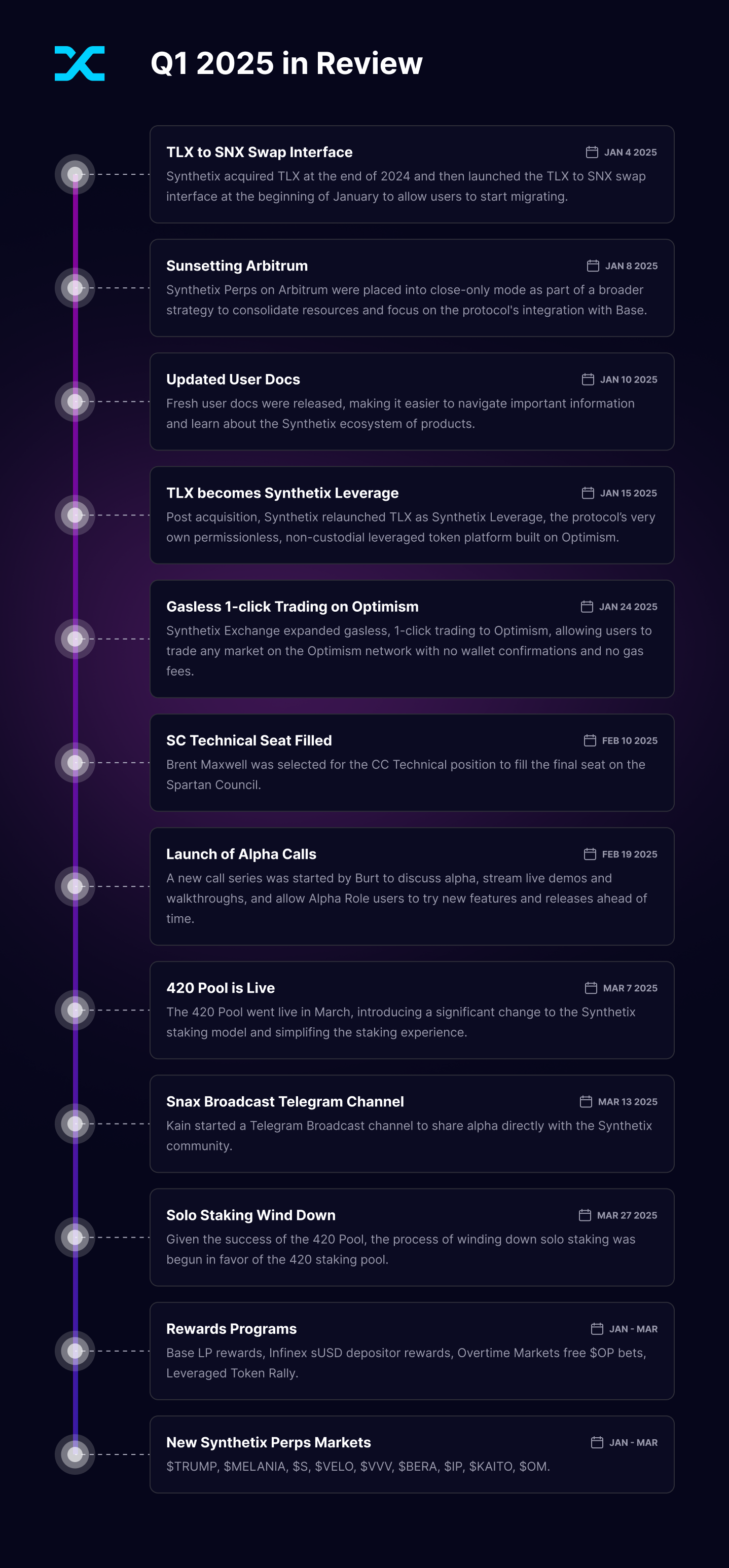

We’ve seen some major momentum shifts and meaningful progress at Synthetix in just the first quarter of 2025! From record-breaking migrations and the launch of the 420 Pool, to expanded Perps offerings, platform upgrades, and protocol acquisitions, signs of growth are visible on nearly every front. The strategic vision is on full display — largely fueled by last year’s governance shake-up referendum — and there’s a renewed commitment to improving accessibility, scalability, and user experience. Together, these developments mark a transformative start to the year and lay a strong foundation for what’s ahead.

Among the most impactful milestones was the rapid adoption of the 420 Pool, which saw over 137 million SNX (more than 40% of the total supply) migrated within just two weeks of launching. This remarkable uptake reflects strong community alignment with the protocol’s transition to a delegated staking model. The 420 Pool eliminates liquidation risk and offers debt forgiveness over a 12-month period, making staking simpler and more appealing to a wider range of users. For the protocol, this shift brings enhanced capital efficiency, more predictable system debt management, and tighter alignment between incentives, governance, and user participation.

This transition has also paved the way for the deprecation of solo staking — a key step in reinforcing the protocol’s move toward a more unified and scalable architecture. With the majority of SNX now concentrated in the 420 Pool, the need to incentivize users to manage protocol debt responsibly is no longer necessary. This allows Synthetix to streamline its operations and focus on refining a single, robust capital allocation model. The sunsetting of solo staking reflects the success of this transition and clears the path for a more consistent user experience and a stronger foundation for future product expansion.

This quarter, Synthetix also introduced a new initiative called Alpha Calls — weekly community sessions designed to showcase upcoming features, gather real-time feedback, and foster greater transparency between core contributors and users. Held on Discord, these calls created a space for early previews of UX updates, product experiments, and strategic discussions, giving the community a more active role in shaping the protocol’s development. By establishing a regular feedback loop with engaged users, Alpha Calls have helped the team quickly identify pain points, prioritize improvements, and test ideas in a collaborative environment. This initiative not only strengthens the protocol’s relationship with its community, but also reinforces a more agile, user-driven approach to building DeFi infrastructure.

Challenges

As Synthetix continues to push forward with ambitious upgrades and new product launches, several underlying challenges have surfaced — particularly around capital retention, incentive design, and user expectations. While the protocol has seen strong engagement from its core community, issues with non-stablecoin LP liquidation rewards, declining TVL, and fluctuating trading activity have come into sharper focus. As the protocol matures, addressing these challenges head-on will be essential to solidifying its role in a competitive and fast-evolving DeFi landscape.

One emerging challenge this quarter has been the inconsistency in LP returns due to liquidation rewards being distributed in volatile assets. While incentive programs have successfully attracted liquidity providers, actual returns have varied widely depending on the performance of the reward tokens — particularly ETH. During bullish market conditions, it was an easy sell to receive LP rewards in an appreciating asset. But as the trend shifted, some LPs found that their rewards lost value, which negatively impacted their realized APR. This led to confusion, as the APR that many LPs experienced differed significantly from the published figure, which had been calculated at the time of distribution. In response, the protocol is planning to launch an auto-compounding vault in the coming weeks that will convert all rewards to USDC, helping to alleviate the burden of managing volatile liquidation rewards.

While adoption of the 420 Pool was strong and trading volumes reflected increased product demand, it hasn’t quite begun to bring in significant amounts of external capital. This suggests that while existing SNX holders are actively engaging with new features, external liquidity may be more reactive to broader market sentiment. A big part of the 420 push was designed to consolidate new capital around more compelling yield strategies and improve onboarding for non-SNX-native users. As Synthetix continues to evolve, attracting and retaining outside capital will be critical for deepening liquidity and scaling the protocol’s impact across DeFi.

Lastly, daily trading volume averaged around $10 million in Q1, with major spikes in February and March as traders flocked to futures markets during periods of volatility. By the end of the quarter, however, trading activity had cooled. While some of this is attributable to broader market conditions, it’s also clear that traders are naturally following incentives. These programs have proven effective in generating short bursts of volume, but the fluctuations highlight the challenge of sustaining consistent trading activity without continuous external motivation. Convincing traders to leave the comfort and familiarity of centralized exchanges remains a key hurdle, especially when faced with the occasionally complex UX of on-chain trading. Fortunately, Ethereum’s upcoming Pectra upgrade, scheduled for May 7, promises to unlock a number of improvements on the UX front, potentially making on-chain trading more seamless and accessible.

Protocol Stats

Overview of Synthetix Q1 Stats: January 2025 — March 2025.

Spartan Council

Q1 2025 Spartan Councilors: Benjamin Celermajer (Fenway), Brent Maxwell, Cavalier, coKaiynne, Jordan Momtazi, Kain Warwick, SpartanGlory

While the first quarter of the year brought a few transitions, the Synthetix ecosystem stayed focused on tightening its core offerings and setting the stage for a more efficient, accessible, and unified future. From major system upgrades to protocol acquisitions and the launch of game-changing features, let’s get into exactly what went down this past quarter.

🤝Kwenta & TLX Join the Synthetix Family

One of the biggest moves from last quarter carried into Q1 with the official rollout of Synthetix’s acquisition of Kwenta. The merger wasn’t just about branding — it marked the beginning of a more cohesive DeFi ecosystem. But Synthetix didn’t stop at just acquiring Kwenta and creating Synthetix Exchange, because the protocol wrapped up its acquisition of TLX in January and relaunched it as Synthetix Leverage — a permissionless leveraged token platform built on Optimism. With over 70 assets and up to 10x leverage, this new product line has been simplifying exposure to Perps while leveraging all the composability Synthetix has to offer.

🔥420 Pool Lights Up a New Era of Staking

By far the most transformative protocol update in Q1 was the launch of the 420 Pool, a redesigned SNX staking model that eliminates common risks and complexities (SIP-420).

On day one, the pool saw 100 million SNX in deposits and kicked off a 12-month automatic debt forgiveness schedule:

- 50% forgiven at 6 months

- 100% forgiven at 12 months

Once migrated, stakers:

- No longer face liquidation risk

- Don’t need to manage c-ratios or debt

- Receive yields from external strategies like Ethena, Aave, and Morpho

And the protocol benefits too! Lower c-ratios (200%) mean deeper sUSD liquidity and more efficient capital deployment for new products.

🌅Synthetix Focuses on Base: Sunsetting Arbitrum

This quarter, Synthetix also began the process of winding down its Arbitrum deployment, placing all Perps markets into close-only mode on January 8. While the decision wasn’t taken lightly, it reflected a broader strategic shift toward vertical integration and network consolidation following the Synthetix Reboot.

Maintaining multiple deployments demands significant liquidity and support overhead. By focusing on Base, the largest and fastest-growing Ethereum L2, Synthetix can concentrate development and resources into delivering a unified, streamlined trading experience. With the rollout of V3 features like gasless 1-click trading, multicollateral margin, and the launch of Synthetix Leverage, Base has become the ideal home for the next era of Synthetix.

All existing positions on Arbitrum remain open and can be closed at any time, but no new positions can be opened. All markets are now available on Base, and users can bridge directly from nearly any EVM chain using the Socket-powered swap interface, making migration fast and simple.

⚡️Gasless 1-Click Trading Comes to Optimism

Speaking of UX wins, gasless 1-click trading was made available on Optimism this quarter in addition to Base. No wallet pop-ups, no gas fees, no delays. Just click and trade. Alongside this release came performance enhancements and response-time fixes on Base.

👋V3 Migration: Solo Staking Winds Down

At the end of Q1, solo staking deprecation officially kicked off as the migration to V3 continued. If you’re still staked on V2X, don’t panic — your SNX is safe and still viewable at liquidity.synthetix.io.

However, c-ratios have begun increasing to force liquidations below 160%, and if you’re liquidated above that threshold, you’ll have a 6-month window to recover your position (SNX + debt).

New Faces, Docs, and Alpha Calls

👨💻Brent Maxwell Joins the Spartan Council

The long-vacant Technical Core Contributor seat was finally filled on the Spartan Council with the onboarding of Brent Maxwell. A seasoned builder across both Web2 and Web3, Brent brings serious engineering firepower to the Spartan Council. With experience across DeFi, NFTs, token launches, and DevOps, he’s stepping in at a pivotal moment for the protocol’s next phase of development.

📚New User Docs

The updated Synthetix Docs launched this quarter, making it easier than ever to navigate the protocol, learn the ropes, and explore what’s possible with SNX.

📞Alpha Calls Debut

As previously mentioned, the new Synthetix Alpha Calls kicked off in Discord, offering early access to new features, live demos, and candid chats with core contributors. Users who want to get in on the early fun can do so by asking Burt for the “Alpha” Discord role — don’t miss the next one!

📣Snax Broadcast Launches

Need the TLDR straight from the source? Synthetix launched the Snax Broadcast Telegram Channel, a no-fluff feed of key updates and alpha from Kain himself.

🔮What’s Next?

With the 420 Pool live, Kwenta and TLX now part of the family, and V3 rolling out fast, Synthetix is entering Q2 with strong momentum — and no signs of slowing down.

Expect:

- More staking incentives

- Enhanced vault products

- Leveraged token expansion

- Liquidity boosts for sUSD

- Continued focus on Base and Optimism integrations

Whether you’re a veteran staker, a leveraged degen, or just dipping your toes in for the first time, there’s a lot more coming. Stay tuned!

Best Memes from Q1

Lastly, because we can’t close out the quarter without a little humor, here were some of the best memes from the Synthetix community.