Stablecoins, which are cryptocurrencies with their price anchored to government-issued currencies, are increasingly popular for payments across the globe, offering a more efficient and cheaper way to move money. As countries roll out regulations for the asset class, more banks are getting interested in issuing their own stablecoin. Spanish bank BBVA, for example, said it plans to issue a stablecoin on Ethereum next year using payment firm Visa’s tokenization platform.

Related Posts

Ethereum, Solana, Doge traders caught off guard as Musk-Trump split weighs on markets

Total crypto liquidations hit $972.22 million in 24 hours, with Ethereum, XRP, Dogecoin, and Solana among the most impacted Long…

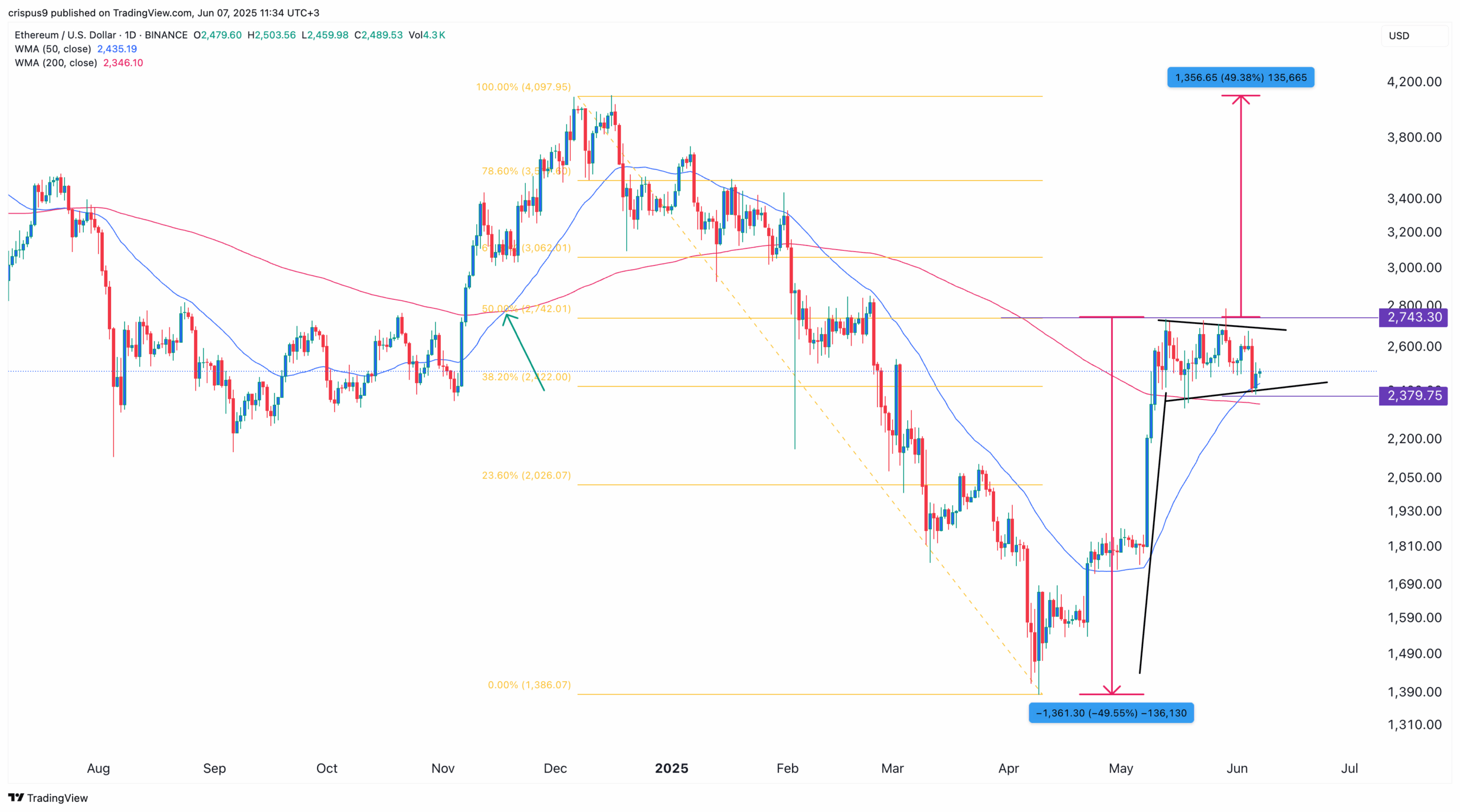

Ethereum price eyes breakout, ETHA ETF nears $5b milestone

Ethereum price may be on the verge of a bullish breakout to $4,000 after forming a bullish flag and a…

Bitcoin, Ethereum going mainstream as JPMorgan, SEC open doors: Binance Research

Binance Research highlighted several major developments that suggest that crypto is breaking into mainstream finance. Crypto is no longer on…