Bitcoin has finally started to change its correlation with US equities, signaling a potential shift in market dynamics. Analysts are calling for an aggressive surge if BTC manages to hold current levels and continue pushing higher. Bulls are feeling increasingly confident after Bitcoin pushed above the critical $90K mark — a pivotal zone that had previously acted as strong resistance during months of consolidation and selling pressure.

While bulls are now in short-term control, risks of a sharp downturn remain elevated. Global trade instability, fueled by ongoing tensions between the US and China, continues to threaten broader financial markets. Fear and volatility have dominated the landscape ever since US President Donald Trump secured re-election in November 2024, creating an unpredictable macroeconomic backdrop.

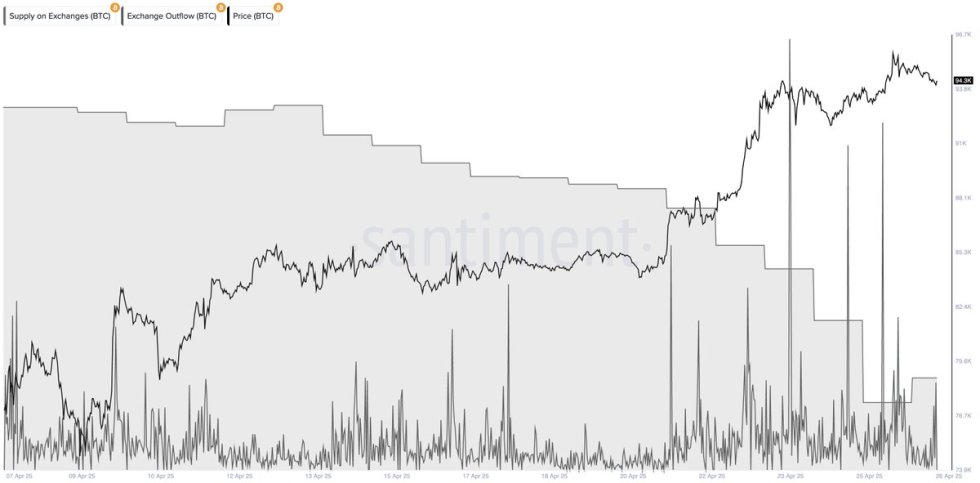

Despite these headwinds, on-chain metrics paint a bullish picture. According to recent data, more than 40,000 Bitcoins have been withdrawn from exchanges over the past week, signaling a strong accumulation trend. This movement suggests that investors are increasingly opting for self-custody, reducing available supply on trading platforms — a dynamic that historically supports higher prices. As the market heads into a critical phase, Bitcoin’s behavior in the coming days could define the next major trend.

Bitcoin Faces A Defining Moment As Bulls Hold Short-Term Control

Bitcoin is now entering a critical phase where price action over the next few weeks could shape the market’s direction for months to come. Bulls are currently in short-term control, following a sharp surge that pushed BTC firmly above the $90K mark. However, despite this momentum, high risks of a reversal remain as global trade instability continues to dominate macroeconomic narratives.

Tensions between the US and China persist, with rising tariffs and fractured supply chains threatening global markets. While some analysts are optimistic, calling for Bitcoin to rally toward new all-time highs (ATH) in the coming weeks, others remain cautious, arguing that recent strength may be a temporary reaction rather than the beginning of a sustained breakout.

A key signal supporting the bullish view is growing investor accumulation. Top analyst Ali Martinez shared relevant data revealing that more than 40,000 BTC have been withdrawn from exchanges over the past week. This strong outflow trend suggests that investors are increasingly moving their BTC into cold storage, reducing available supply and reinforcing the foundation for a potential price surge.

As Bitcoin hovers at critical resistance levels, the coming days and weeks will be pivotal. A continued surge could confirm the start of a new bull phase, while failure to hold key support zones could lead to renewed volatility.

BTC Price Update: Bulls Hold Steady As Critical Levels Loom

Bitcoin is currently trading at $93,900, maintaining a strong position after an impressive multi-week rally. However, while bullish momentum persists, it appears that a clean push above the $95K–$96K resistance zone may take additional time. This range is a critical hurdle, and many analysts expect some consolidation before any decisive breakout occurs.

For now, bulls must focus on defending key support levels to keep the recovery structure intact. Holding above $88,700 — roughly aligned with the 200-day moving average — would be a major sign of strength. This level has become an important pivot point, helping to confirm whether the rally can sustain further upside pressure.

If Bitcoin fails to hold above $88,700, it could trigger a deeper correction, with the next significant support zone sitting around $84,000. A move down to this area would still fit within a broader bullish structure but would delay attempts at setting new all-time highs.

Overall, the $88,700 level remains the key battleground. Bulls must continue to defend it while preparing for a potential retest of the $95K mark in the coming sessions. Patience and stability are critical as volatility remains elevated across financial markets.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.