I want to start off with this: I didn’t think I’d ever write this article. Last cycle (2021), I was not involved in NFTs, didn’t buy anything that didn’t offer “utility” and loved my DeFi coins.

This cycle, my view has changed significantly. So what happened?

Broken promises and seeing through 8 years of crypto bullshit.

I’m part of the 2017 class of crypto which in my view, was still one of the most exciting cycles in crypto (2020 takes a close second). Why? Because for the first time in history, you could raise capital from anyone, anywhere in the world in less than 10 minutes. Now of course this was rife with scams but the net innovation cannot be ignored. Ethereum is an ICO coin, Aave, Gnosis and countless more. There’s something truly magical having the ability to raise capital without the gatekeepers of Silicon Valley. Coming from New Zealand/Australia, I was never geographically close enough to ever reach that pool of capital without disrupting a high quality of life that this part of the world offers. ICOs gave me hope that regardless of my location, talent and the best could come out on top (assuming they could build and market). The feeling of hearing crypto parties where people huddle over into a laptop, transfer $5m and close a deal is insane in any other universe.

Unfortunately, with all good times, they came to an end. In the aftermath, during 2018/2019, we had to pick up the broken pieces including the raft of retail investors that got hurt and the countless lawsuits that happened as a result. Despite crypto being an incredibly risky industry, founders and investors wanted something “safer”. So they opted for the new model of:

-

Raise money privately for your earlier rounds

-

Raise money privately for your later rounds

-

Do an airdrop at the giga-top valuation

Basically, we’ve recreated the old system. How do you get in these “deals”, well same story but different characters. Be part of the crypto elite who has access to these deals, and then wait as your bags appreciate. I won’t lie, I’m a net beneficiary of this system. I’ve been lucky to be an angel investors on tokens that have appreciated significantly by the time they were listed publicly. Majority of my investment track record has been from public markets though. I do know of lots of friends and investors that have made unbelievable amounts with this new system. Rather than being in Silicon Valley, you just need to be big on Twitter now.

Now, I’m not saying that people who have social capital shouldn’t be able to convert that to financial capital. That’s just how the world works. Where the problem lies is in the incentives of this system. I’ve written about this in countless ways but I’ll spend a bit of time recapping it.

The problem with this new system is that it’s more corrupt than even the existing financial system. Here’s typically what happens:

-

The first round of investors will receive a valuation somewhere between $10m-$50m for whatever the token/project is. Given that most tokens have the chance of being worth $1b you’re looking at 20x-100x worth of upside. This round is easy to sell out and will usually go to insiders. This is fine since this is also how regular venture investing works.

-

Now that there’s enough capital, you can get to work building and shipping. Once you ship something, you dangle the carrot of “airdrop” to users. The deal is simple, use our product and we’ll eventually pay you in our token. Oh and if you use multiple wallets you get more because you boost our metrics. Your job is to indirectly pay people to use your product without promising anything at the same time.

-

With these new metrics, the project can sell larger dreams of what they’ll achieve. Growth stage capital can come in and write larger cheques to these companies. You can raise $50m on a $500m valuation if your dreams are ambitious enough. This is where you start to wonder, if they’re investing at a $500m valuation — their investors need to be able to see at least a $5b valuation. In order to achieve this, you want investors with the loudest marketing and social influence (or cashflow but that usually doesn’t even exist at this stage). Keep ‘em on standby because you’ll all need to work together in the next stage.

-

As you get closer to launching your token, you amp up your marketing and social presence. More people find out about the project and token and will use it feverishly in hopes of an airdrop. This cycle is as strong as 20 year old male cycling steroids to achieve gym gainz.

-

Once the marketing campaign is at it’s all time high, launch the token and ensure liquidity for your investors and team members. You can also cash out secondaries beforehand if you’d like. What happens after this point isn’t really in your control because people will dump their tokens to get their liquidity and move on to the next thing.

Side note: there are teams our there there aren’t in it for the reasons above and will ensure proper 4-year vesting schedules for team members and investors, thoughtfully execute an airdrop and will strive to get accurate data. These are the exception and I hope they win.

The result of this cycle is basically a ton of products and things that no one really wants but will continue to repeat: why? Because that’s the only way people can make money in this market. Access to the earlier rounds and the growth rounds are restricted. Your only chance of making it is putting money into untested smart contracts and hoping to receive $1,000-$10,000 after months of using a shitty product across multiple wallets. What about the utility of these tokens?

-

Most of them offer promises of “governance”. Well guess what, majority of the tokens are owned by insiders so your voice doesn’t matter anon. How can you find out? Well you just need to invest lots of time to understand the composition of the wallets and how past governance votes have gone down.

-

What about “cashflows”? Well, yes some might have cashflows, but do you ever receive them as a token holder? No, of course not. This might change with the UNI fee-switch but till then we’re in a stalemate.

-

What about “innovation”? Key team members have already become multimillionaires and may only kind of care about the success of whatever they produce from this point onwards. How can you tell this? Only if you have access to insider information through discussions with people who are inside the industry.

-

What about “growth”? Well, the airdrop and the metrics were all bogus so none of it was actually real. Most of the users and money will flow to the next “hot” thing and leave you forgotten as last cycle’s relic. There is always a new project with hotter investors and more yield farmers that will steal attention away from you and offer larger bribes.

-

What about “future price appreciation”? Well you need to understand the entire supply schedule and when more tokens will be unlocked so that insiders don’t dump on you and become exit liquidity.

The system works in a way that perpetuates short-term, mercenary behaviour with noisy data. People aren’t dumb and quite frankly, they’re sick of it. Why make tons of insiders rich when there’s a new alternative: memecoins.

Crypto was meant to be a place where the playing field is levelled out for everyone and we can operate with transparent, fair distribution.

Bitcoin is the perfect example of this:

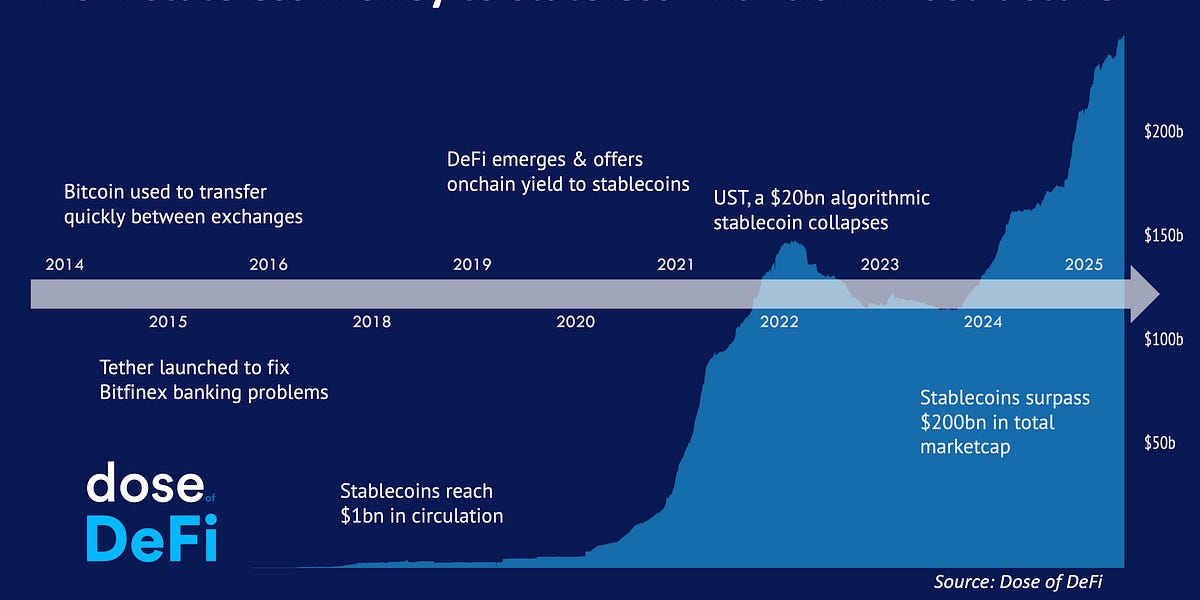

I’m not saying this is feasible or required for every token, but it does represent the flavour of crypto that makes it revolutionary compared to the current financial system where:

-

New dollars get printed to those closest to the printing

-

Information is opaque and hard to verify

-

Value is barely given to those who create it (citizens)

In many ways, the current crypto system has start to resemble the old way of doing things (tokens distributed to insiders, data hard to verify, investors capture majority of value). Instead, memecoins offer on the original crypto promise in a unique twist.

I want to start off with a common phrase that people say all the time

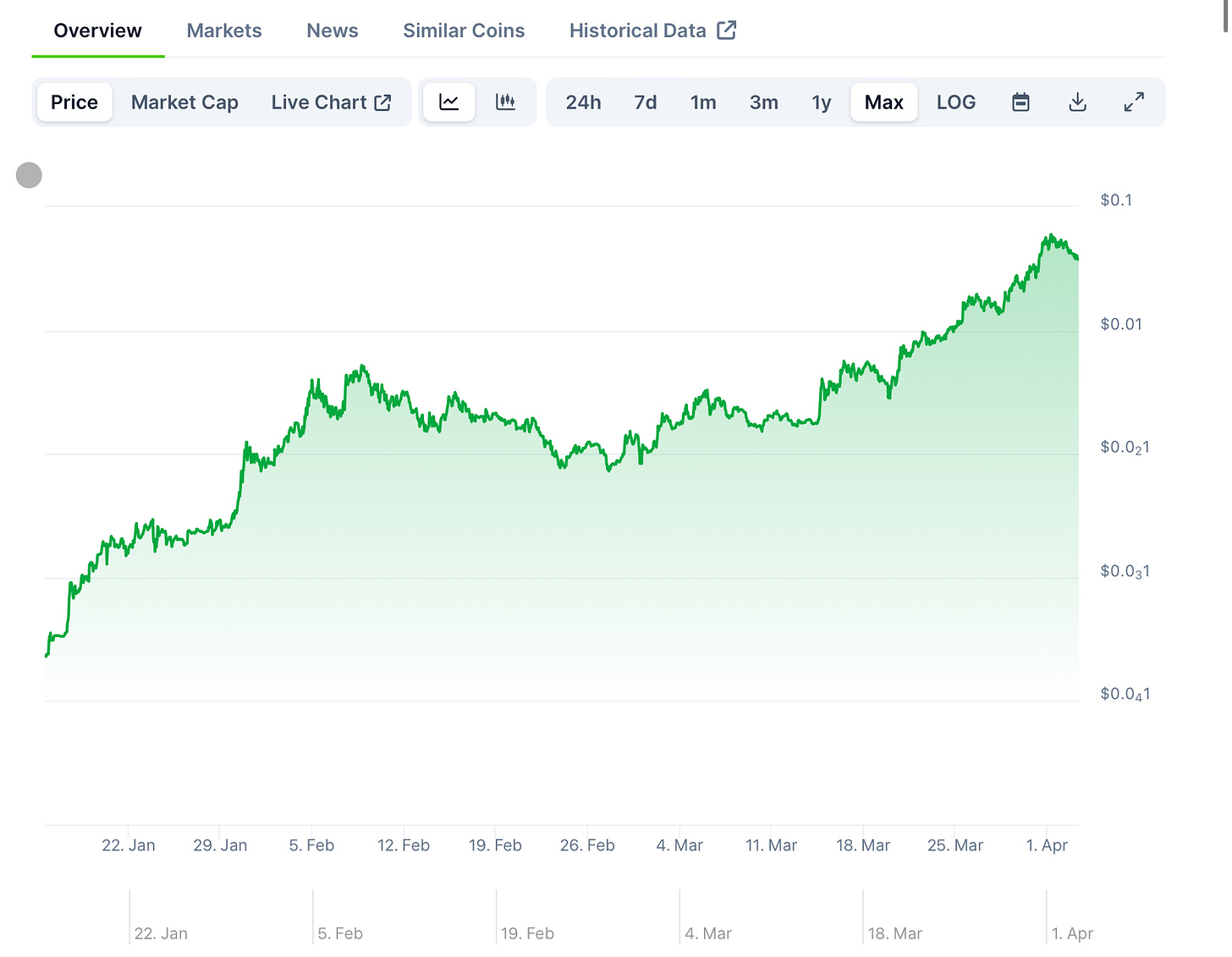

I use to say this all the time too. But let’s look at the data, shall we? Here is a chart of Dogecoin’s market cap since 2014 (to log scale because the increase in price is too large to chart properly). This is for a coin that has no utility outside of the logo being a widely recognised breed of dog called Shiba Inu.

You’d be far richer investing in DOGE than even NVIDIA.

So shouldn’t this coin be going to 0? Well, the opposite actually. It’s continued to climb aggressively and has actually outperformed Bitcoin. An ~8,000x return is hard to ignore. Four magnitudes of appreciation.

You could just say “well Doge is special, it’s an outlier”. I think that’s a weak answer and requires more digging. Let’s examine some properties of Doge:

Doge does not lie about what it is. It doesn’t favour those with social capital. There are no insiders who got special access. If you believed in internet culture and crypto, you could get some yourself.

But I want to extend this example to further illustrate my thesis in different but similar ways.

I’ve written about Farcaster here before but there’s a new playbook emerging that we will see become huge in the coming few months and years. To illustrate this, I want to use something different: Reddit. Recently, Reddit IPO’d at a $6b valuation. Majority of that value was created by the users of the platform. However, the best Reddit could do was offer their users a chance to invest in the IPO at multi-billion dollar valuation. They might get a nice little return but nothing that’s going to change the trajectory of their life in any meaningful way.

When Farcaster launched and I was writing about it, there was a little experiment brewing on there called $degen. The idea was fairly simple, you get allocated a certain amount of $degen and can then distribute it to people who had good posts on Farcaster by commenting “50 $degen”. The more you tip, the more you earn. In lots of ways, it was simple but also amazingly good at distributing value. As usual, I was skeptical and ignored this as I thought “another ponzi scheme that will go to 0 because it has no utility”. However, the thing that $degen achieved was capturing the mindshare of Farcaster people. As Farcaster grew, so did the mindshare of $degen and eventually — the price.

$degen is still very young (3 months old) and will have many challenges in it’s journey ahead. Although it represents something new and novel that I think, despite a bear market — will stand the test of time. However, it’s easy to look at charts like this and think “what if I invested at $x”.

What I wanted to illustrate with this piece was what you can achieve by actually participating. One of the largest $degen holders who I know personally is Cooper Turley. He’s been very involved with Farcaster and $degen. His public wallet has held close to $250k of $degen. Purely from participating.

These are the stories that I came to crypto to see, not the same corrupt system with new characters.

During the rise of $degen, it’s now being used as a go-to-market strategy for startup. Alex Masmej, who is building at the intersection of TikTok and crypto, incorporated $degen as the primary currency in their product Dracula. This has created a symbiotic relationship between Dracula and $degen. Memecoins as go-to markets are starting to become a more prominent theme moving forward. I’ll expand more on this in the next section.

Degen does have minor pre-allocations and has sold tokens to “Farcaster” insiders but in far smaller amounts that I personally think are reasonable. I hold very little $degen despite seeing it’s meteoric rise due to mid-curving it.

Dogwifhat. Probably the most hated memecoin on Crypto Twitter right now. First time I heard about it, I looked down in disgust about it. “Those filthy leftcurvers pumping trash again” is what I remember thinking. However after learning the story about with this dog, I found it intriguing enough to change my mind. I own a tiny position of $wif and am considerably late to the game (multi-billion dollar market cap).

You see, the photo of dogwifhat starts off years before it was actually a coin. It was a popular internet meme that had vitality baked into it. The photo is one where you look at it and can’t help but say “that’s a pretty cute dog with a hat”.

Now, late 2023 a Solana developer launched $wif. However, upon the token pumping hard enough in the first 2 days he cashed out his share for $32k leaving the distribution “clean” so to speak. There was no supply overhang left. His current share if he didn’t sell would be worth over $1b. Given then token distribution was basically first come, first serve, wif has grown to an unprecedented scale.

$wif is incredibly easy to understand: it’s literally just a cute dog with a hat. There are no investors to worry about to sell on you, there are no promises, there are no cashflows. It literally is what it is.

It’s simultaneously hilarious and deceptively simple. Most will probably miss out on it though.

“But Kerman, are you really telling me that we should all be buying coins that literally do nothing and have cute dogs or communities and offer nothing else”?

Firstly, what you decide to invest or not is a you problem, not the scope of this article. My second point, is what are the alternatives? When you scroll down the top 100 coins on CoinGecko, you will find a plethora of tokens that:

-

Don’t offer any real utility when you pull back the curtain, most of them are lies

-

Have huge supply overhangs from investors

-

Generate no cashflows

So comparatively speaking, memecoins and “utility” coins are the same thing. I prefer coins that are honest about where they’re at and don’t require me to analyze 100 different variables on top of all the other things I need to keep up with.

“But what happens when the bear market hits and they all drop in value”?

Well guess what, EVERYTHING comes crashing down 50%-99% in a bear market. You’re not describing anything that’s different to every other coin out there. At least with memecoins, there are no lies or false promises that finally get unveiled like majority of the tokens out there. AI/L2/ZK coins are the biggest perpetrators of this trend at the moment. They lie about the state of the technology, have huge supply over hangs and are listed at ridiculously high valuations. I almost despise these coins (not the project or people behind it tho).

Crypto has been plagued with lies and an industry rife with corruption. Memecoins, in an unusual twist of events are the answer to fight back. A revolution inside the revolution so to speak.

They’re easy to buy now (Solana), easy to understand (cute dog) and honest about what they are (no fancy technology or financial jargon to confuse you).

Whether you like them or not, they’re here to stay.

They will come down in value like the rest of the market in 2-3 years, but I bet the most elite memes will live on in our minds and prosper in the bull market of 2028 to make epic comebacks — like Doge.

The question is: are you a good meme connoisseur or a fool buying scam coins from devs trying to make a quick buck and run? I’ll leave that to you.

Memecoins as the future can also represent a financially nihilistic future — people gambling their way out of poverty. There should be the alternative to be able to invest at ground floor prices in technology that makes the human race happier or productive. Not just selling the dreams of doing so.

While I could choose to spend my time gambling on memecoins, I’m a believer that with better identity, reputation and data primitives we can create a better on-chain society. This is where I am spending my time and choose to build accordingly. Based on my recent articles about airdrops there’s lots that I’ve been learning behind the scenes and am excited to share as my team and I ship.

I hope that these new products will help to solve the problems we have with crypto at the moment.

However, for now, memecoins may be the best honest alternative.

Full disclosure, despite my bullishness I still keep memecoins sub 5% of my portfolio. I expect this to grow significantly as memecoins show their continued staying power and appreciate significantly as the elites overlook them.