In the filings, the prospective issuers revealed the final details of the fund structures, including management fees, which turned out to be relevant for investors when choosing which spot bitcoin ETF they would invest in when they debuted early this year. Experts have said that the fee war in this round of launches would be similar to the competitive landscape then, when issuers kept lowering their fees to compete with other funds.

Related Posts

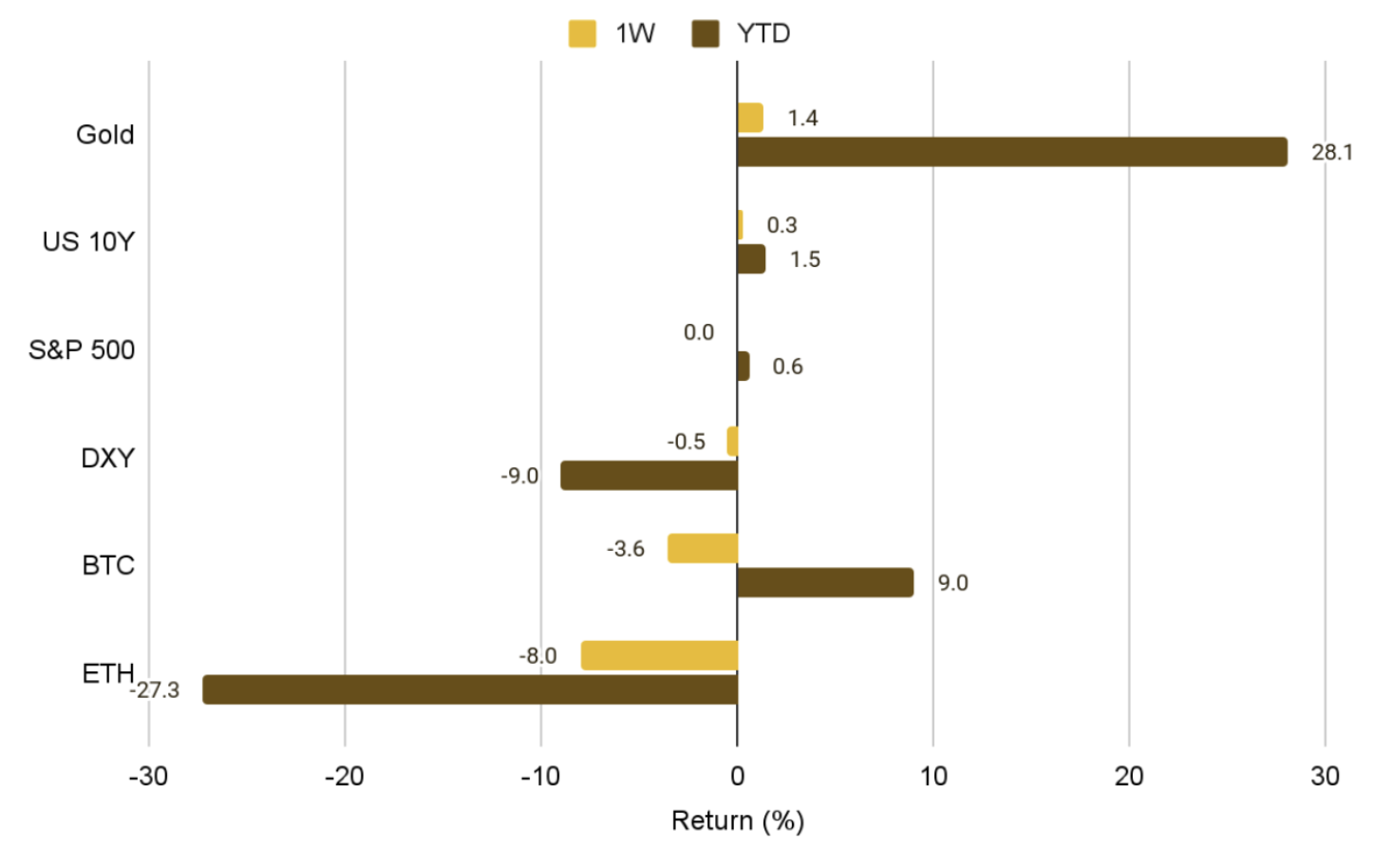

Ethereum, Solana, Doge traders caught off guard as Musk-Trump split weighs on markets

Total crypto liquidations hit $972.22 million in 24 hours, with Ethereum, XRP, Dogecoin, and Solana among the most impacted Long…

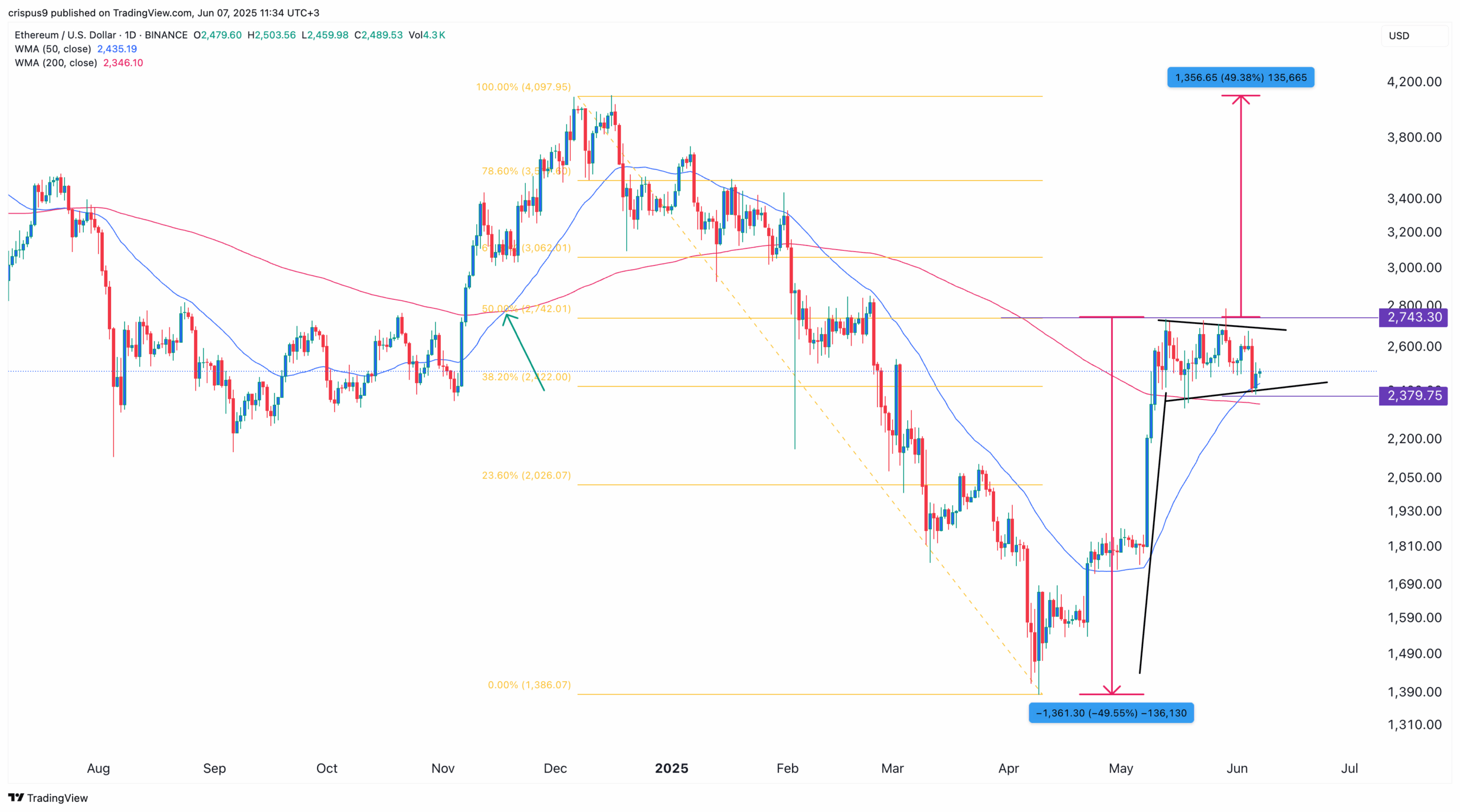

Ethereum price eyes breakout, ETHA ETF nears $5b milestone

Ethereum price may be on the verge of a bullish breakout to $4,000 after forming a bullish flag and a…

Bitcoin, Ethereum going mainstream as JPMorgan, SEC open doors: Binance Research

Binance Research highlighted several major developments that suggest that crypto is breaking into mainstream finance. Crypto is no longer on…