Asset manager Grayscale, in a report in April, argued that Ethereum is “meaningfully decentralized and credibly neutral for network participants, likely a requirement for any global platform for tokenized assets” and, therefore, has the best chances among smart contracts to benefit from tokenization.

Related Posts

Ethereum, Solana, Doge traders caught off guard as Musk-Trump split weighs on markets

Total crypto liquidations hit $972.22 million in 24 hours, with Ethereum, XRP, Dogecoin, and Solana among the most impacted Long…

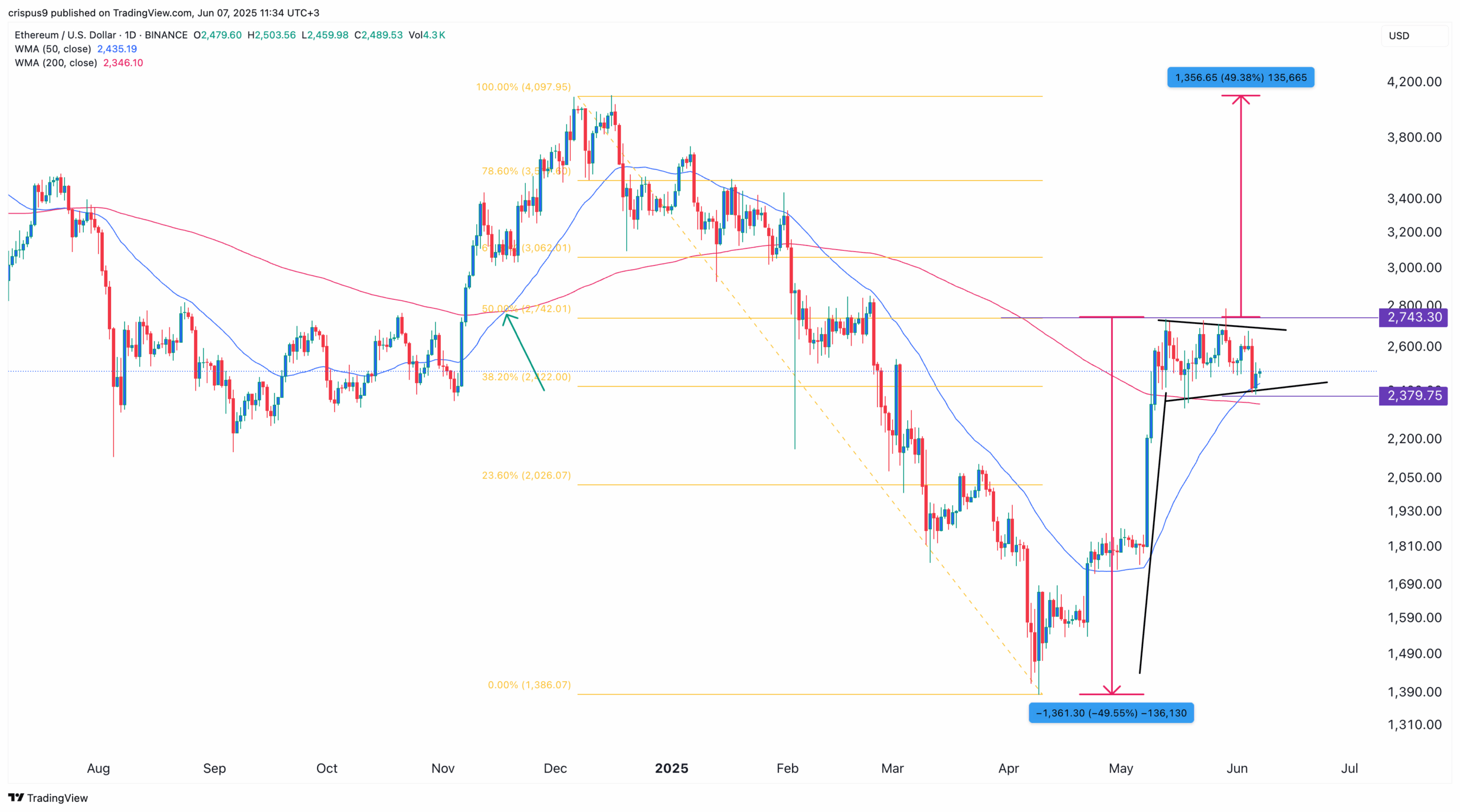

Ethereum price eyes breakout, ETHA ETF nears $5b milestone

Ethereum price may be on the verge of a bullish breakout to $4,000 after forming a bullish flag and a…

Bitcoin, Ethereum going mainstream as JPMorgan, SEC open doors: Binance Research

Binance Research highlighted several major developments that suggest that crypto is breaking into mainstream finance. Crypto is no longer on…