Ethereum’s price has pulled back in recent days as some whales continue to sell their tokens.

Ethereum (ETH) retreated to $3,058 on Monday, Nov. 18, from this month’s high of $3,445. This retreat means that it has moved into a local technical correction after falling by 11% from its highest level this month.

Ethereum’s price action happened as some whales continued selling their coins. Data by LlamaFeed shows that whales have moved ETH tokens worth over $300 million in the last 24 hours. The biggest whale movement moved 50,000 ETH tokens valued at over $153 million to Kraken and paid a transaction fee of $12.80.

Another notable whale moved 15,579 tokens worth $47.8 million to Coinbase. Moving tokens to exchanges is usually the first step that investors take when liquidating.

Ethereum’s price also dropped as spot ETFs experienced outflows for two consecutive days. Outflows stood at $59.8 million on Friday, a big increase from $3.24 million a day earlier. Altogether, these ETFs have achieved inflows worth $178 million compared to Bitcoin’s $27 billion.

Meanwhile, the blockchain has continued to underperform other smaller networks in the DEX industry. The volume handled in its DEX networks dropped by 4.7% in the past 24 hours to $850 million. In contrast, Solana (SOL) handled $5.92 billion, while Base, BSC, and Arbitrum handled $1.28 billion, $1.27 billion, and $992 million.

Still, some analysts are optimistic that Ethereum’s price may be about to bounce back in the longer term. One analyst expects that ETH’s price will ultimately jump to $10,000 in the long term, implying a 226% rally from the current level.

Other analysts cited more catalysts like its deflationary nature and the potential for staking in ETFs now that Trump has won the election.

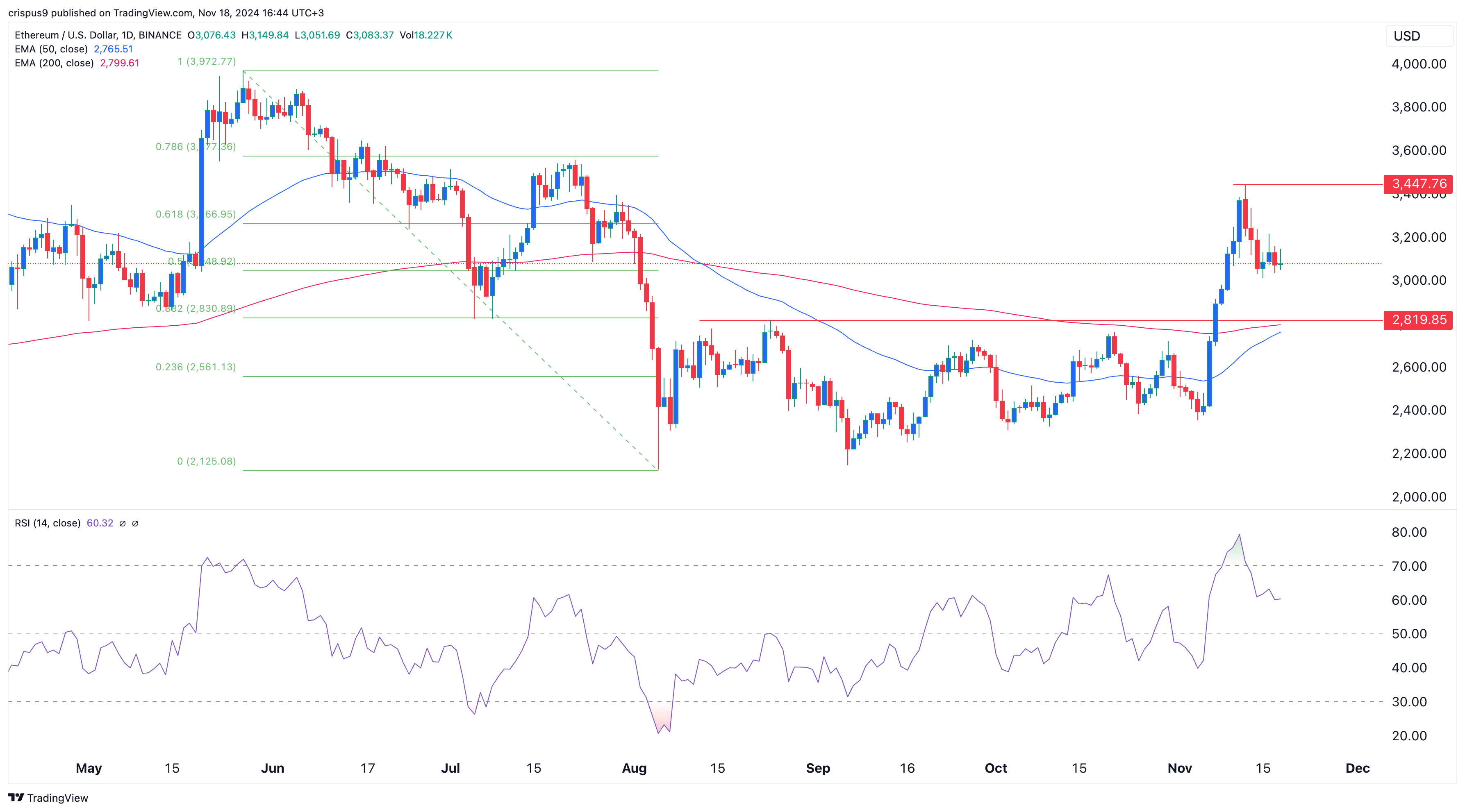

Ethereum price has bullish technicals

The daily chart shows that Ether has some bullish catalysts. It is about to form a golden cross pattern as the 200-day and 50-day Exponential Moving Averages are about to form a bullish crossover.

The recent Ethereum price sell-off has also started to lose momentum at the 50% Fibonacci Retracement level. Therefore, there is a likelihood that the ETH token will bounce back in the coming days. If this happens, the initial target will be at $3,447, its highest level this month. A break above that level will point to more gains to the year-to-date high of $3,972.