Bitcoin (BTC) entered its final week of the year down 30% from its $126,000 all-time high reached on Oct. 6. Has BTC finally peaked, or is there a relief in the cards going into 2026?

Key takeaways:

-

A typical “Christmas bear trap” may precede a potential relief rally into 2026.

-

Cooling ETF outflows, less long-term holder sell pressure and macro factors suggest an extended bull cycle is possible.

-

BTC’s symmetrical triangle projects a 22% increase to $107,000.

Bitcoin’s many bullish signals

Bitcoin’s 2.6% drop from a high of $90,000 reached on Monday could be a classic “Christmas bear trap,” according to analyst James Bull.

A bear trap is a false technical signal where price briefly breaks below a key support level, triggering sell-offs and stop-losses, only to quickly reverse upward, trapping bears (short sellers) in losses.

Related: Bitfinex whales go long BTC for 2026: 5 things to know in Bitcoin this week

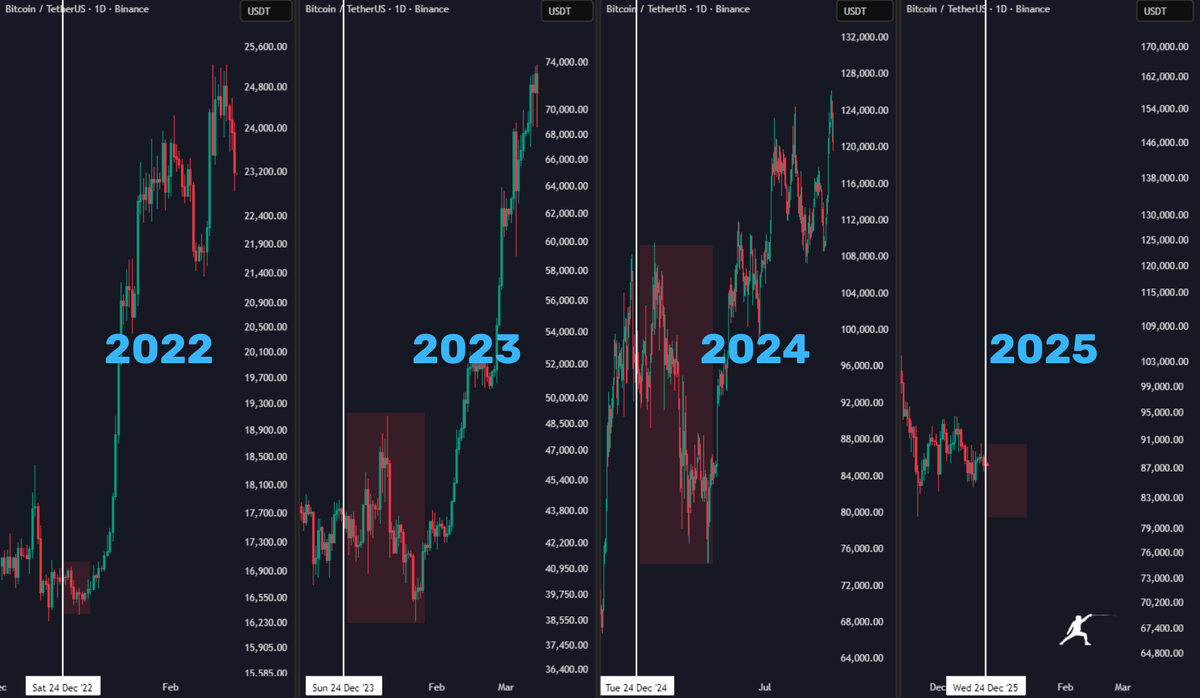

Bitcoin is setting a “Christmas bear trap, which will be reversed in January like in the last 4 years,” James Bull said in a Monday post on X.

Looking at the most recent case, the BTC/USD pair dropped 8.5% between Dec. 26 and Dec. 31, 2024, before reversing with a 12.5% between Jan. 1 and Jan. 6, 2025.

Fellow analyst The ₿itcoin Therapist said that with the four-year cycle broken, Bitcoin may rise to a new all-time high in the first quarter of 2026, setting up the “greatest bear trap in history.”

James Bull added that the invalidation of the four-year cycle could signal the end of the old retail-driven boom-bust cycle amid a changing Bitcoin market structure characterised by growing institutional adoption via ETFs and corporate treasuries. This, coupled with macro factors such as rate cuts and liquidity, may propel BTC price to new highs in 2026.

Meanwhile, Citi Group analysts set a 12-month base case prediction for Bitcoin at $143,000, driven mainly by “revived ETF demand,” with the bull case target set at $189,000.

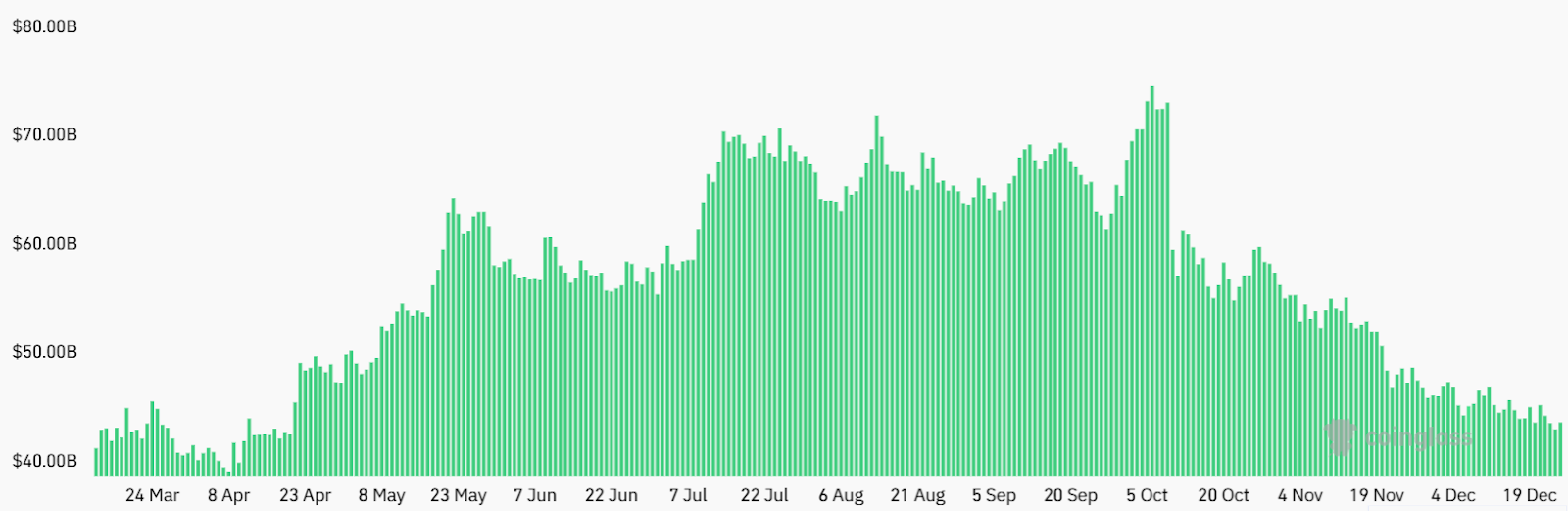

Regarding spot Bitcoin ETF flows, James Bull said the outflows have reduced significantly from -1,600 BTC on Nov. 21 and are now “going toward zero.” The chart below shows that a similar scenario in April preceded a 33% price rally to $112,000 on May 22. Bull added:

“This isn’t a guarantee for Bitcoin to go back to ATHs, but it’s a strong signal.”

As Cointelegraph reported, Bitcoin selling pressure from long-time holders is showing signs of cooling off, reinforcing the potential for a January 2025 relief rally.

BTC price symmetrical triangle targets $107,000

Data from TradingView shows the BTC/USD pair consolidating within a symmetrical triangle on the daily candle chart, as shown below.

The price needs to close above the upper trendline of the triangle at $90,000 to continue the upward trajectory, with a measured target of $107,400.

Such a move would bring the total gains to 22% from the current level.

“Bitcoin forming a symmetrical triangle pattern,” said analyst Dami-Defi in a recent analysis in X, adding:

“If Bitcoin pushes above that upper trendline and holds above, we’re likely looking at a bullish breakout to those higher resistance levels around $94K and then up near $106K.”

As Cointelegraph reported, a bullish daily close above $90,000 would spark a new rally toward six figures.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.