A small US logistics firm hit headlines after announcing plans to hold the TRUMP memecoin as part of its treasury. Freight Technologies Inc.’s share price surged over 100% on Friday after reports of the announcement.

According to a Bloomberg report, the lesser-known company intends to utilize proceeds from the sale of convertible notes to acquire the politically-charged crypto asset, which has a connection to US President Donald Trump.

As of Friday, stock in Freight Technologies Inc had risen 108%, making its market value stand at $4.6 million. The price of the TRUMP token, however, did not display a lot of movement on the day.

Plans To Start With $1 Million In TRUMP

As reported by Bloomberg, Freight Technologies is starting the plan with a $1 million buy of TRUMP tokens. The firm could increase that to up to $20 million in the future. It’s one of the first publicly traded companies to announce TRUMP as a primary digital asset in its reserve.

The action seems to be less of an investment and more of a wager on name recognition and hype. TRUMP is a memecoin, and memecoins are notorious for wild price volatility. The coin didn’t fluctuate much following the announcement, which may indicate that the market isn’t responding the same way as investors did to Freight’s stock.

Company Already Holds $8 Million In FET

Freight Technologies is not a stranger to crypto. The company had earlier purchased $8 million worth of FET tokens. FET is the native cryptocurrency of Fetch.ai, a decentralized platform with an emphasis on artificial intelligence. That investment was confirmed as of April 29.

TRUMP Coin price up in the last 30 days. Source: Coingecko

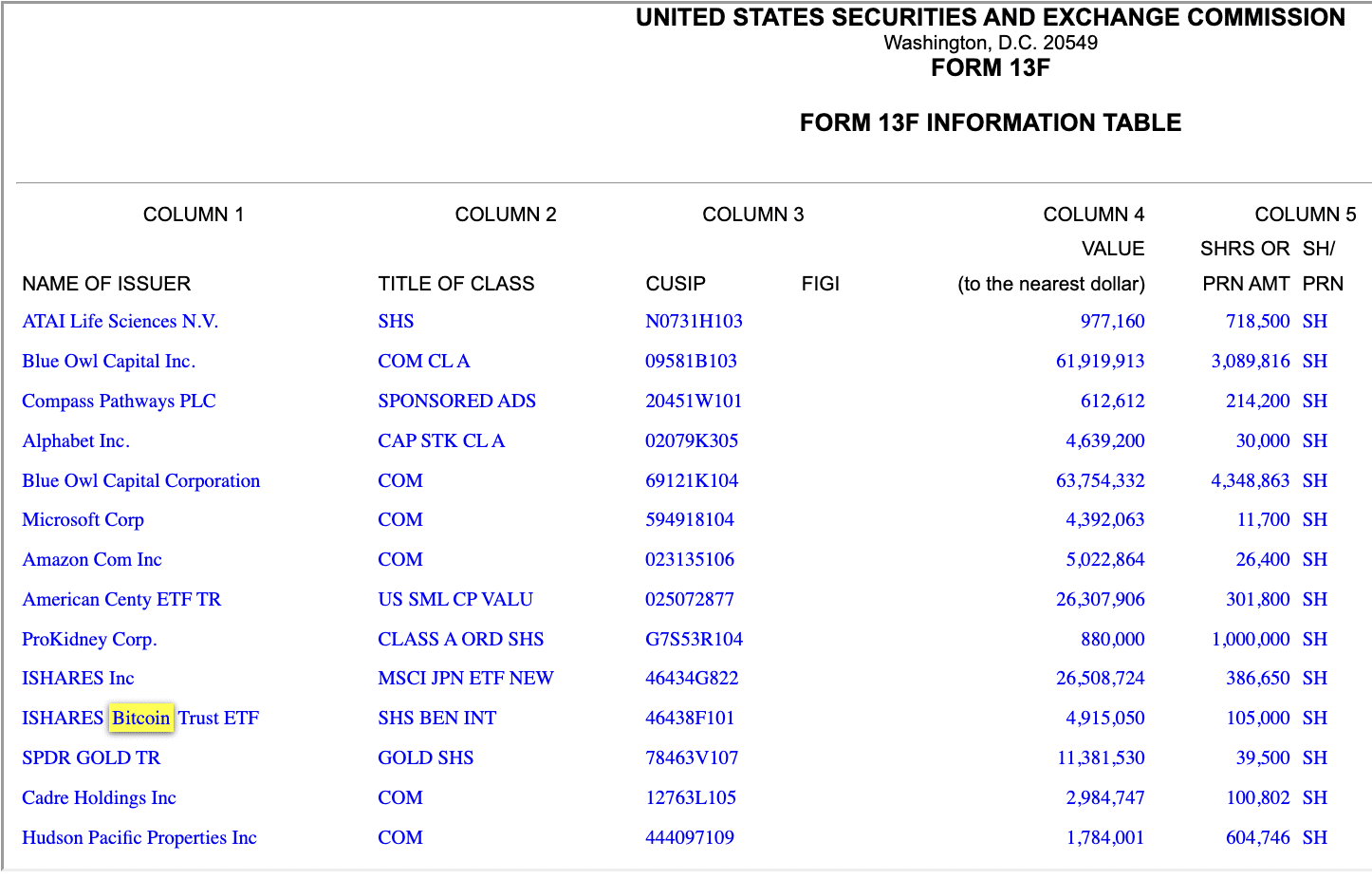

Bitcoin Leads Corporate Reserve Movements

Other firms are taking an opposite route when it comes to crypto reserves. Strategy and Metaplanet are both Bitcoin-focused, not memecoins. On May 1, Michael Saylor announced Strategy doubled its plan to raise $42 billion in equity and another $42 billion in fixed income—just to purchase more Bitcoin.

The firm also said it earned nearly 14% in yield in BTC and a profit of close to $6 billion year-to-date. In 2025, Strategy aims to increase that yield by a quarter and profit to $15 billion. Metaplanet is also setting aside 3.6 billion yen to top up its Bitcoin reserves.

Featured image from 9News, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.