ICYMI: Check out last month’s post on the expanded ecosystems that Ethereum rollups are building.

Maker has had a busy 2023. It reduced its direct exposure to USDC to just under 10%. Instead, it is reinvesting USDC is has acquired via the PSM into off-chain assets (okay Real World Assets) that generate a higher yield. It has more than $1.2bn invested into short-term treasuries from MIP65 Monetalis Clydesdale Tracker with an estimated yield of 4%. More recently, on June 1 it started earning 2.6% on a deal to re-invest $500m with Coinbase Custody. On top of this, MakerDAO governance is in the midst of a massive rate-hike campaign (I guess the Fed made it look like so much fun). An executive passed on May 1 that raised the stability fee for WBTC vaults to 4.9% and then another executive passed two weeks later that raised ETH and ETH LSD rates to as high as 1.75%. Those are small compared to the upcoming hikes that have already passed initial governance polls. These changes, which are expected to be included on the on-chain executive vote later this month, would raise ETH and LSD Dai borrowing costs to 3.5% and WBTC’s to nearly 6%.

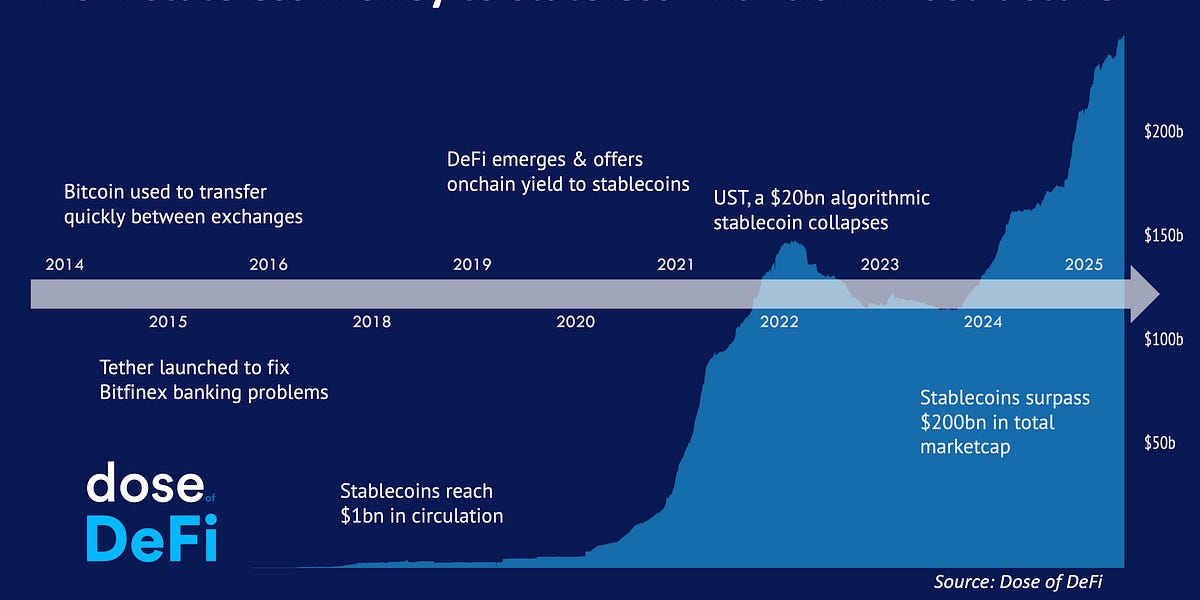

Given Maker’s business model, these higher yields on stablecoin assets and higher interest rates on borrowing will significantly increase its revenue (as can already be seen by the chart above). Some of this revenue will be paid back to Dai holders as MakerDAO governance also plans to increase the Dai Savings Rate to 3.49%. The hope is that the easy yield on Dai will keep investors from fleeing DeFi to the easy, safe and higher yields in TradFi. The downside risk is that borrowers abandon Dai and go to other credit platforms with lower (market-driven) rates.

Related – DeFi Llama News: Rune Christensen on his Endgame plan

It was a momentous week for crypto regulation. After years of dancing around and hinting at enforcement, the SEC is coming after the largest names in crypto, Binance and Coinbase. The Binance case will be jucier, but the fate of Coinbase will be far more revealing for the future of crypto. The case is likely to take 2-4 years to run its way through the courts and the bright lines drawn by the SEC might spur legislation from Congress over that time period. The only question left is if the SEC is going to also go after a DeFi protocol (presumably Uniswap).

I appreciate the tweet above from the patron saint of Crypto Twitter, because it underscores what makes blockchains and DeFi different. Now, we must communicate those use cases and the future promise to the broader political system.

-

Uniswap introduces FLAIR, a metric to measure LP performance Link

-

PoolTogether lawsuit dismissed by US judge Link

-

Paradigm comment on SEC’s proposed redefinition of exchange Link

-

House Republicans propose comprehensive crypto market structure bill Link

-

72% of MEV searcher revenue went to validators Link

-

Catalyst, a new cross-chain AMM Link

-

Token Terminal: On-chain derivative market share Link

-

crvUSD onboards stETH as collateral Link

That’s it! Feedback appreciated. Just hit reply. Written in a Nashville before its too hot.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. All content is for informational purposes and is not intended as investment advice.